Good morning. Happy Wednesday.

The Asian/Pacific market closed mostly down – losses were small. Europe is currently up across the board – gains are small. Futures here in the States point towards a small gap up open for the cash market. This comes off a strong bounce last week and a light-volume give back yesterday.

Tonight starts the first of two Jewish holidays that fall at this time of year, so I expect volume to be light again. This is fine considering the market needed to do a little backing and filling after last week’s surge put some very short term indicators into overbought territory. After a counter trend takes place, I expect the market to move up again, but the market has some proving to do. Last week’s bounce was easy because so many participants were stacked on one side of the market. Now is the hard part for the bulls. Real buyers must step up to keep the movement going. This won’t be easy.

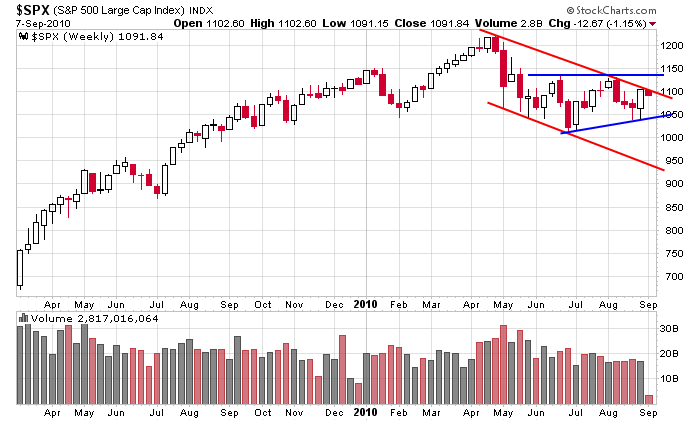

Yesterday I posted the daily S&P. Today I’m posting the weekly. It’s either a falling rectangle (bullish implications) or rising wedge (bearish). Until the market makes up its mind, we need to keep our holding times short term. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 8)”

Leave a Reply

You must be logged in to post a comment.

Hi gang! The Jewish holidays start this evening. More importantly, we are on the cusp of getting out of the end of month/beginning of the month bullish cycle which is once again,

the last two trading days of the prior month and the first four or five trading days of

the new month. Sometimes, but not always, this can be exacerbated if there is a legal

holiday intertwined into the mix. Caveat empor. Let the buyer beware. Especially now. HW

There are additional formations that should be considered as well, e.g. from the May low, you can make a case for a triangle formation with last week’s rally being an ending “E” (of an ABCDE triangle) which may have ended on Friday. As long as this advance does not break above the August high (point D of the triangle), this triangle interpretation is valid. Given the preceding down move prior to this potential triangle, the expectation would be for break down in the direction of the downtrend since the April high with a tatget of 870-950.

http://www.cmegroup.com/education/events/2010-08-25-26-ifm-futures-and-options-series-3.html

at 7 bills a pop I’ll delay that one and stick to all the free stuff.

My understanding is that you have to be sponsored to take one of these exams? True?