Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up…Japan and India gained more than 1%. Europe is currently up across the board…there are a couple 1% winners there too. Futures here in the States point towards a gap up open for the cash market.

Very soon the market will have to decide what it wants to do next. The near term trend is up, but resistance is front and center and several key groups including the small caps, banks, semis and oil are lagging. Either it’s onward and upward and the bears will have to scramble to cover or the market is going to come down hard. It’s not going to just sit here.

There’s an FOMC meeting tomorrow, so a decision may be delayed until Wednesday.

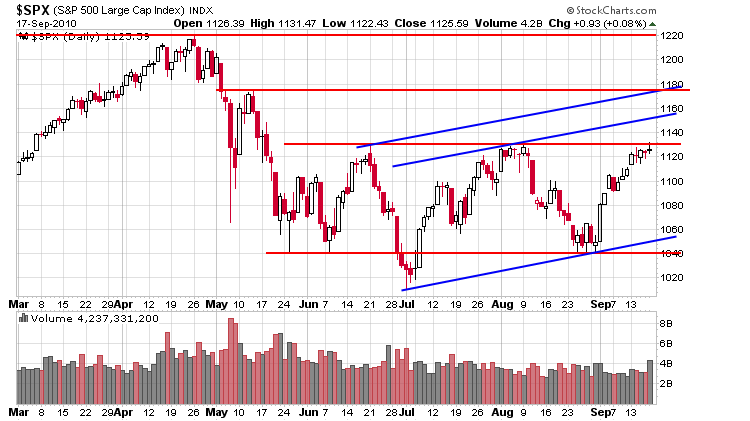

Here’s the S&P 500 daily. I have nothing new to say that wasn’t already said in the report or video I put out over the weekend.

Be patient, be nimble. Resolution comes soon.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 20)”

Leave a Reply

You must be logged in to post a comment.

Hi Jason

Japan was closed due to holiday.

Ditto

Ah, thanks. I didn’t notice the date on the quote.

Hi Jason! I was looking at the $SPX chart that you posted today. The red horizontal lines

are clearly defined at overhead resistance touch points, but the blue lines are subject to open interpretaion. The only blue line that makes sense is the bottom blue line connecting

the July low of around 1020 to a ‘potential’ sell off later this week to around $SPX 1050.

Differing opinions…that’s what makes a market.

Everyone on the planet sees those red lines, so odds are they won’t be be meaningful. My blue lines on the other hand are not seen by many, and they’re not as random as you think. They’re drawn parallel to the lowest blue line and through a high of the range.