Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down – losses were moderate. Europe is currently mixed – movement is very small. Futures here in the States point towards a slightly positive open for the cash market.

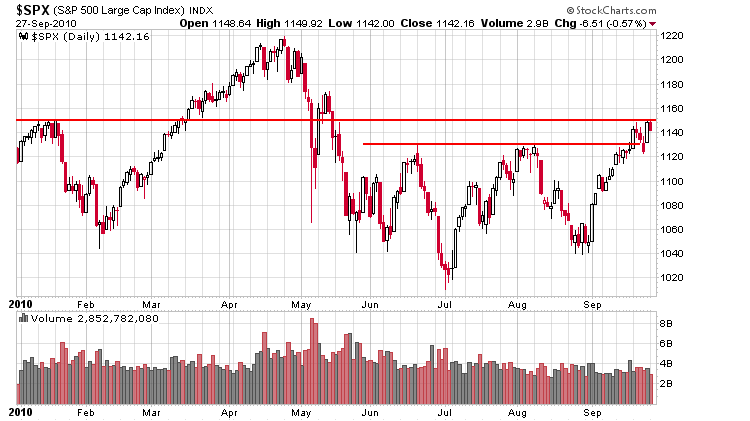

The S&P got turned back by 1050 yesterday – a level I pointed out a couple weeks ago as potentially being just as significant as 1030. So far it has been, and it’s a reason why although my bias is to the upside, in my opinion, the market is not ‘in the clear.’ Here’s the SPX daily.

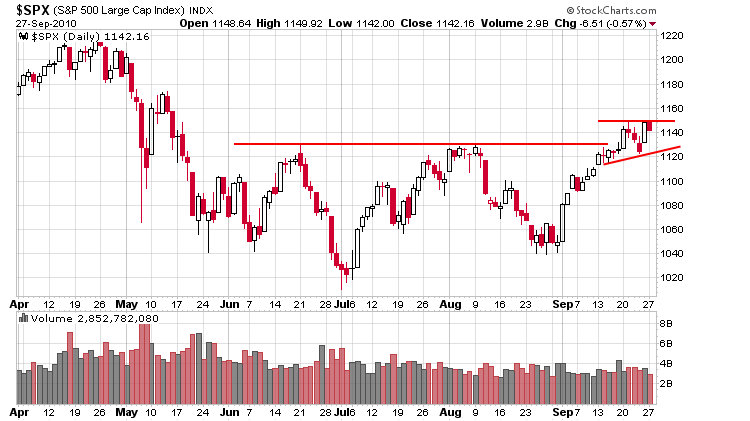

Here’s another shot of the daily. A small ascending triangle is forming. Further weakness to add to yesterday’s give-back would be healthy and set the stage for a more explosive breakout later. But a move above resistance now would constitute a higher high, not a breakout – a pattern that has less explosive potential.

The trend is up…continue to manage your positions wisely.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 28)”

Leave a Reply

You must be logged in to post a comment.

Hi gang! Once again we are approaching the bullish seasonality turn cycle dates.

For those of you who missed it last month here it is again: The last two trading days

of the current month as well as the first four or five trading days of the new month.

This bullish condition can be (but not always), exacerbated by a major holiday thrown

into the middle of a long holiday weekend. Regards, HW

The market: my guess, head-fake, shaky-shaky, and then an aggressive climb to Jan. nine.

Jason, so you think the flash-crash was manmade and not a perfect storm? Does it matter? One has to expect the unexpected.

I have no idea if it matters…I just don’t believe the stories that explain why/how it happened.

Forget about all the rhetoric! Disregard the hype! CNBC does not even exist in my mind.

Trade the chart man, just trade the chart and that’s about how to day trade successfully. HW

Trade the chart? Naa! I like guessing, bigger thrill.

Rich, that was my mantra, 70% drawdown later. I’m a little gunshy!

RichE: Well if you trade like that….at least you can take it as

a tax loss at the end of the year. Provided you live that long. HW

I’m paper trading it this year.

It’s based on Van Tharp’s system analysis.

So far:

TOTAL P/L YTD: $17,776.00

SYMBOL YTD P/L

/ESM0 $8,437.50

/ESU0 $6,662.50

/ESZ0 $637.50

/NQM0 ($40.00)

BLK $1,037.00

SPY ($17.00)

VECO $1,043.50

WDC $15.00

vooooooooooooop voooooooooooooooooooooooop 🙂

What does that mean?

It means your full of Crap !

You don’t need a slide rule to day trade.