Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Europe is currently trading mostly down.

Employment numbers are out. Here they are:

unemployment rate: 9.6% (9.7% was expected)

nonfarm payrolls: -95K

private payrolls: +64K (85K expected)

gov’t payrolls: -159K

average workweek: unchanged

hourly earnings: flat at $22.67 (0.2% rise was expected)

Futures were down ahead of the numbers and then fell further but have now recovered and are above the pre-numbers level and flat relative to yesterday’s close.

So far it’s been a moderate up week, but all the gains were registered in a single session (and half the gains on that day came in the form of a gap up).

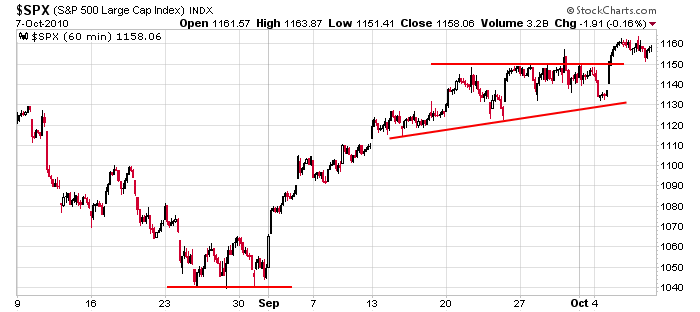

Here’s the SPX 60-min chart. A rock solid rally off the Aug lows followed by a couple weeks of consolidation followed by a breakout. From a charting standpoint, there’s nothing wrong with this picture.

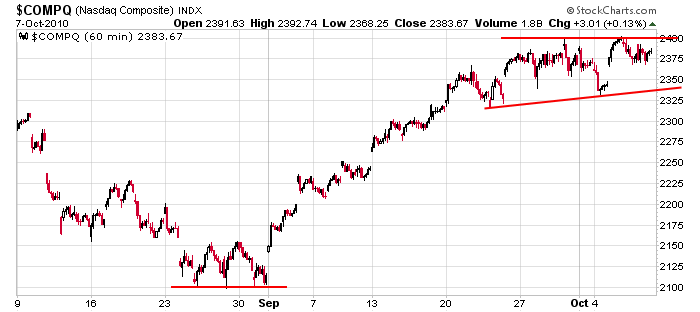

Some indicators are overbought, and I talked yesterday about how the risk right now is much higher than it’s been for several months as evidenced by the great number of stocks suddenly gapping up or down. Another warning comes from the Nas which has not broken out.

The intermediate term trend is up. Short term flip a coin. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 8)”

Leave a Reply

You must be logged in to post a comment.

We’ve seen days like this before when the market gets off to a slow start.

Maybe some selling at the open, and then it snowballs down into the

mid-day hour. I am calling for a down morning with some possible

traders buying the dips later on in the day much like we saw yesterday. HW

Flip a coin. ROFL

One T-shirt, when you going public with that company?