Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up – there were several 1% winners. Europe is currently mixed with a bullish bias. Futures here in the States point towards a positive open for the cash market.

This is a big week for the market because there’s lots of unknown event risk looming. Tomorrow is election day. Wednesday is FOMC day, and then the latest employment numbers get released Friday.

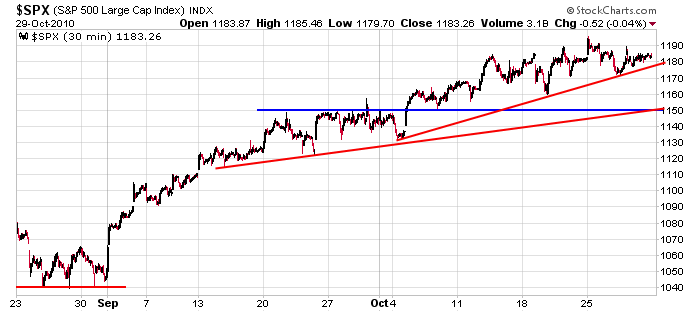

The trend is up, but the S&P has closed within a 20 point range for three weeks. There’s an old saying about not shorting a dull market which I agree with, but I also can’t justify be super aggressive on the long side here either. We could get a quick and sudden move in either direction any time.

The market is supposed to be weak in Sept and Oct. This year it was strong. In fact I don’t think it would be wise to use any type of historical tendency to predict the next move. The fact that the market has held up so well may hint at its strong relative strength, but it also sets up a “buy the rumor, sell the news” situation. You never know when the floor will be pulled out.

Here’s the 30-min S&P chart. If the market rolls over, my first target is 1150.

That’s it for now. Be careful out there.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 1)”

Leave a Reply

You must be logged in to post a comment.

whipsaw those bulls/bears–then the retailers can t/o

Aussie JS: You are the man from down under and you need to expand

your broad band width. 1) What did you mean by your last comment,

‘then the retailers can t/o’ 2) Have you had any vegamite lately? HW

Howard,-i told u i had a weird sence of humour,–makes up for my bad spelling

—even have to bring my vegamite with me when i come to good old usa–land of the retailers and out back steak house

when the insto’s and pomo are finally broke and out of ideas then the retailers will move in and finish them off with their shorts,making billions and thus we will have a new class of big boys as in the 30’s and the cycle goes on

isnt that darwin isum or is it spiritual ism,but at least there will be no more mark to fantasy

AUSSIE JS; In plain American English, sir, are you a bull or a bear?

Contrarian minds want to know. Thanks, HW/nyc

Hi Howard–didnt see ur q to after trades—-i dont know–nor do i know which way the market will go

longer term ,i suppose i am a ferocious,vicious bear in a bull suit,but as a daytrader i have no bias–the market goes each way many times a day and u have to make ur mind up very fast of a trend change

as a person i know many many have bought the govt lies and cover ups that this is a recovery like 2004 and all will be well –even with so much soverign ,usa state,bank mark to fantasy

DEBT–WORLD WIDE

i could go on and on if u know what i mean,but this is not the right forum for that

i will just say this–its not all in the charts–just yet

what is in the charts is what the fed- pomo-bigboy instos want to be in the charts—-BUT THAT IS ALL WE CAN TRADE

in future i will strictly keep to what Jason has to say to enhance the forum

i had a great short nite on ftse-dax-dji-spx ndx-xjo—didnt take any longs

its our melbourne cup –horse race today–all oz stops for it –so may not be fit to trade tonite–oops its 8am tues morn here–so gunna get some sleep first

if only i could buy a t shirt with a big teddy bear on it to match my ferocious claw gloves for the usa deep freeze winter,then i would be set

just love it how europe –oops usa big boys based in london push usa futures up for gap up opens so as i can sell into strenght

the bulls /bears are getting squeezed into doji doughnuts atm,but a clear trend soon

the insto bigboys are obstensibly so bullish atm that i wonder if thats not just a ramp front

for the chicago fin /trade show

went to chicago once–got out of the airport for a cig–it was a freezing blizard -went back to the airport and caught a plane for oz

but my family do have booths their for the bridal show but in summer

americain won the melbourne cup horse race today so we are trying to help dji 12000

now that would be a nice shortable event