Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed and with a bullish bias. Europe is currently mixed with a bearish bias. Futures here in the States point toward a gap down open for the cash market. This of course comes off three very good days which put the small and mid caps at new highs and the large caps right at their early-Nov highs.

By some measures there may be too much bullishness in the near term. Within the S&P 1500, there have been more than 1000 advancers for three straight days. It’s been three months since this has happened, so in the near term the market may need to rest but overall I fully expect the uptrend to continue.

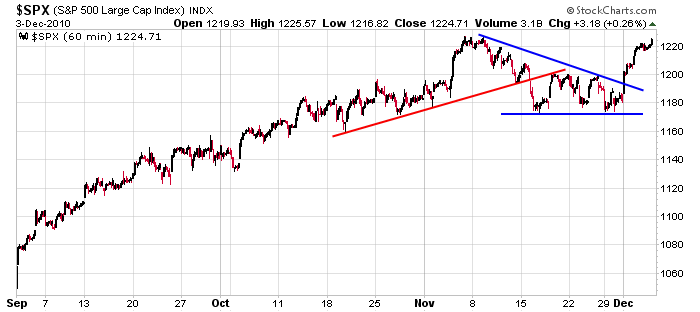

Otherwise I don’t have anything to add to my weekend report. The market has gone from consolidation mode to clicking on all cylinders in just a couple days. Here’s the 60-min SPX chart. It’s not “in the clear,” but it’s doing well. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 6)”

Leave a Reply

You must be logged in to post a comment.

Ground control to Major Tom. Ground control to Major Tom.

Neal: When you are flying an airplane at 33,000 feet and

you see storm clouds ahead you don’t need any technical

indicators to tell you to change course//Now even Bernanke

is getting worried that QE2 may not be enough to get us

out of the hole and it hasn’t even been deployed yet. HW

If I smoke some more pot I’ll go from

33,000 feet to 44,000 feet or higher. HW