Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed, but there were some sizable losses. China dropped 1.6%, India 2.4% and Indonesia 4.2%. Europe is down across the board. Futures here in the States indicate relatively large gap down for the cash market. This comes off a week the market closed up and in the middle of its intraweek range but felt kind of weak.

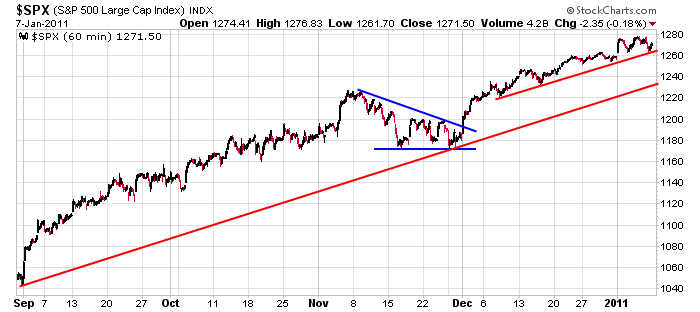

Here’s the 60-min SPX. You can’t argue with the trend, but with the great number of warnings signs and the fact that the S&P has gone 27 straight days without dropping 0.5%, you gotta think we’re due for a surprise move down. I don’t trade off such thoughts (which means I’m not short), but I definitely do scale back on longs and shift more into management mode rather than trade initiating mode. That’s where I’ve been for a couple weeks.

The dollar is up this morning…there are lots of divergences…there are lots of non confirming indicators. The trend is up, but I remain in conservative mode. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 10)”

Leave a Reply

You must be logged in to post a comment.

Vindicate. I’ve never heard that word used before

within the realm of stock market technical analysis.

(I beleive to ‘opine’ your opinion is more appropriate,

at least Sean Hannity and Bill O’Reilly would use

that word instead).

Your web site is devoted to Longs taking a breather? Nice!

Thanks for the info.

Jason: Ivolatility agrees with you.

While the major indices continue working their way higher two of the notable current leaders, the Russell 2000 ETF (IWM) 78.52 and the DJ Transportation Average ETF (IYT) 93.53 are testing their upward sloping trendlines and there are still two unresolved divergences in our indicators: the McClellan Summation Index and the 9-week SPX relative strength indicator. Based upon this some caution is still advisable.

Rich,

Neil has called for the 12000, its hard to believe but here we are within a hairs width of it.

Thanks for you concern regarding my subs, but they don’t read this blog. They have access to me all day long inside the member’s section of the site where talk about set ups and trades etc all day long. 🙂

Yes recently I’ve said caution is warranted. With a strong trend I’ll alternate between being aggressively long and being cautious. Other than a couple weeks here and there, I’ve been long since the March 2009 low. Anyone who has followed my words has probably been long 90% of the time and either flat or close to flat the other 10%.

Jason