Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

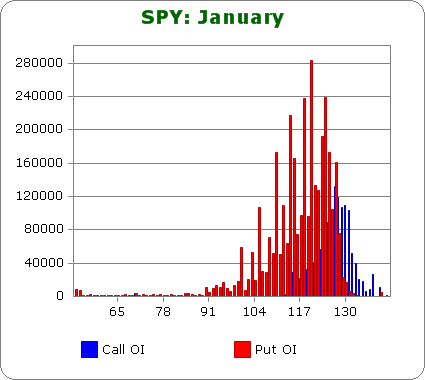

SPY (closed 129.30)

Puts out-number calls 2.4-to-1.0 – slightly more bearish than last month.

Call OI is highest between 127 & 131.

Put OI is huge from 127 on down to 110.

Since the largest call and put blocks meet at 127, a close there Friday would certainly cause lots of pain. With SPY recently closing at 129.30, a couple call buyers will make money if SPY is unchanged by Friday’s close, but it doesn’t matter because there are so many more put buyers who will lose everything. Flat or slightly down movement the rest of the week will cause the most pain.

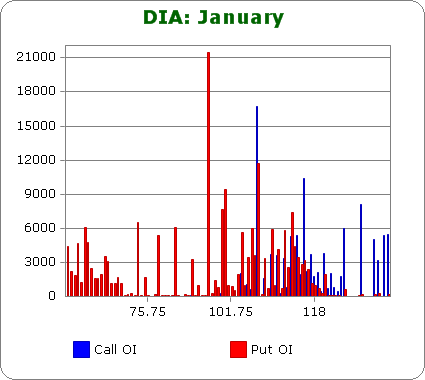

DIA (closed 117.69)

Puts outnumber calls 1.9-to-1.0 – slightly more bearish than last month.

I know enough about options to make money trading them; I don’t know enough to make sense of DIA’s sporadic put and call open interest. Volume with SPY options is 20X greater than DIA, so I don’t think it’s even worth attempting to make sense of this graph.

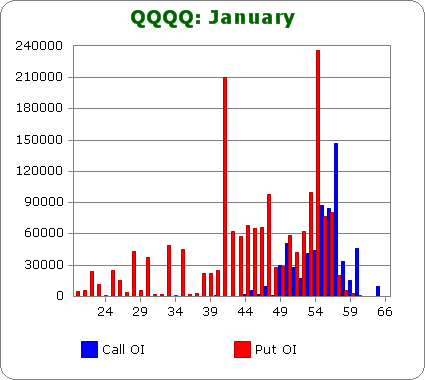

QQQQ (closed 57.00)

Puts out-number calls by 2.4-to-1.0 – more bearish than last month.

Call OI is steady between 50 and 57 with a big spike at 57.

Put OI is solid between 41 and 56 with big spikes at 41 and 54.

There’s some overlap at 56 and 57, so a close around there would cause lots of pain. Said another way, as long as QQQQ closes between the huge put spike at 54 and call spike at 57, lots of pain will be administered. With QQQQ closing at 57 on Friday, we need flat or slightly down movement the rest of this week.

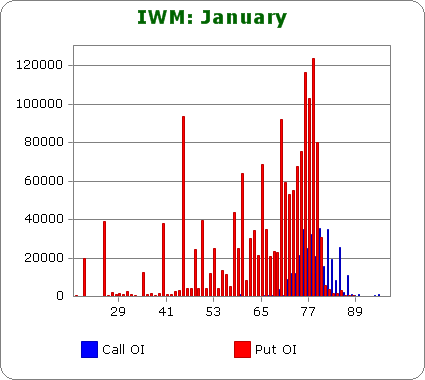

IWM (closed 80.54)

Puts out-number calls by 3.6-to-1 – more bearish than last month.

Call OI is heaviest between 75 & 80.

Put OI is highest at 79 and below.

There’s some overlap between 75 & 79, but since puts dominate calls, let’s focus on those. As long at IWM closes above 79 next Friday, most put options will expire worthless. Considering the current level (80.54), flat or slightly down movement this week will do the trick.

Overall Conclusion: The bears upped their bets this month, and again they’re likely to lose big time. For the most part, flat or slightly down trading next week will expire most options worthless and cause the most pain.

0 thoughts on “Using Put/Call Open Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

I’m somewhat new to Leavitt Brothers, but I’ve noticed whenever you analyze “Using Put/Call Open Interest to Predict the Rest of the Week”, the result is always the same, a flat or slightly up or down week will cause the most pain. Is there every a week where a big move will cause the most main, down or up?

It does seem like most of the movement needed to cause lots of pain takes place prior to the week just before expiration day. Perhaps I should write the report a week sooner to see if there’s a difference.

Jason

Gosh, it must be fun to fight the tape. Maybe there is a lot of hedging going on given the low options premiums.

I would like to be tken off your emailing list.

TX ,

Bill

If you want to be removed, go to the bottom of the email and click “unsubscribe.”

Bill, more than your perhaps realize, i understandand and respect your position but there is good information here to balance against other positions.

I look forward to this analysis every month. thanks for the work