Good morning. Happy Tuesday.

The bulls did exactly what they needed to do yesterday…they dug their heels in and defended their turf. Considering the proximity to the bottom of the channel, there was little room for error. The market closed mixed and flat – a small victory considering sentiment had turned negative and the trend over the last couple weeks has been down.

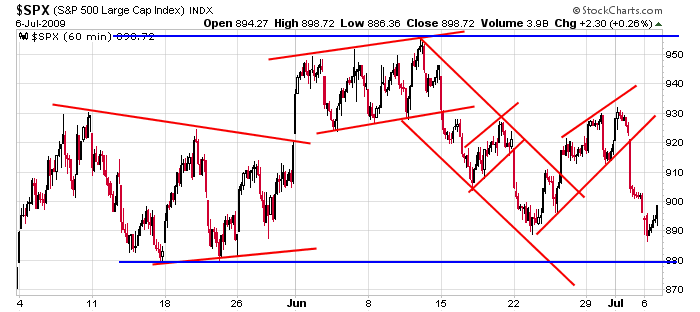

Here’s the 60-min chart. Dips get bought, rallies get sold. My bias leans to the downside, but I’m not one who believes in “lines in the sand.” Even if support is taken out, I’m not going to throw all caution to the wind and put everything I have into bearish set ups.

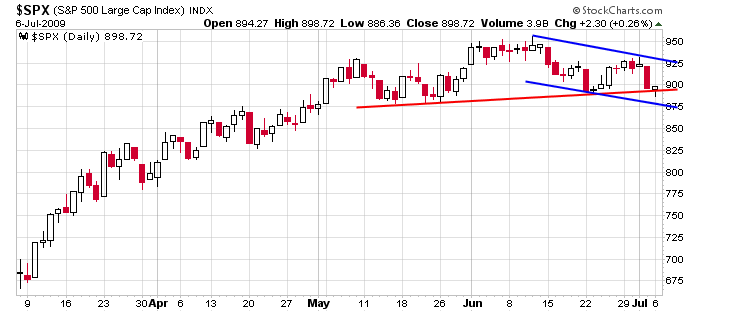

Here’s the SPX daily. Everyone and their brother sees the head & shoulder top. I also see a potential falling rectangle pattern. That’s why in my eyes a new low doesn’t automatically spell doom for the market. False breakouts occur often. A 2-month low would certainly put a dagger in the hearts of the bulls and get the bears super excited. It would also perfectly set the stage for a rally. Anything can happen. You know that by now. Expect the unexpected.

My bias is to the downside, but I’m still playing good defense.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases