Good morning. Happy Thursday.

The big question as we head into a new day is whether yesterday’s high-volume late-day bounce had any meaning. The near term trend is down – lower highs and lower lows have been registered. Shorts have been more fruitful than longs. Sentiment is bearish, and considering the time of year, the path of least resistance should be down.

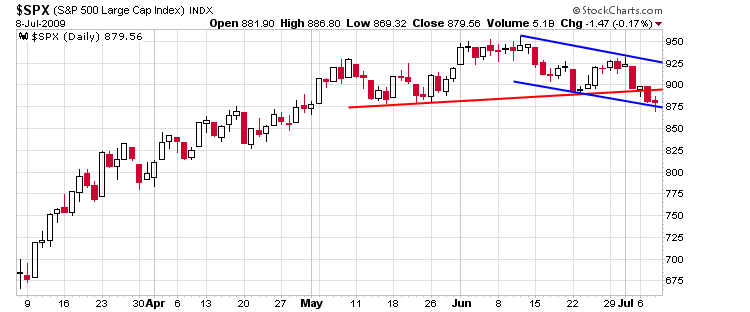

But yesterday’s bounce didn’t randomly occur. It started near a level I’ve been talking about for a couple days. Here’s the SPX daily. I drew the lower blue line over the weekend and said: “Don’t assume the market will melt down if support (red line) is penetrated. Buyers may come in at the lower blue line which is drawn parallel to the upper blue line.” So far, this is exactly what has happened.

I don’t believe in “lines in the sand.” With individual stocks, yes, often penetration of certain levels leads to huge buying or selling pressure. But the same doesn’t play out with the indexes or overall market.

The futures market suggests a decent gap up at today’s open. Sellers could easily come in and drive prices back down to the lows….or sellers may only be able to control things long enough to fill the gap before buyers step in again…or the shorts could get squeezed out of the gate. In any case, I still consider the trend to be down, so that’s where my bias lies. But we gotta play good defense. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases