Good morning. Happy Friday.

Nothing was resolved yesterday. We were wondering if Wednesday’s high-volume, late-day move up had any meaning, and with yesterday’s small-range day, no clues were given.

My bias has been to the downside; it remains there. Nothing happened yesterday to get me excited about going long – especially heading into a weekend.

Trading has nothing to do with certainties and everything to do with probabilities. Right now the odds favor the downside, so that’s where I’m focused. For me to change my mind, I’d need a solid move up followed by a pause or some backing and filling before another move up, but this isn’t likely to happen now. The internal breadth indicators are coming off their highs and are nowhere near oversold levels. Charts of individual stocks are not in good shape – or at least not set up for trades to the upside. For now I’m sticking with shorts.

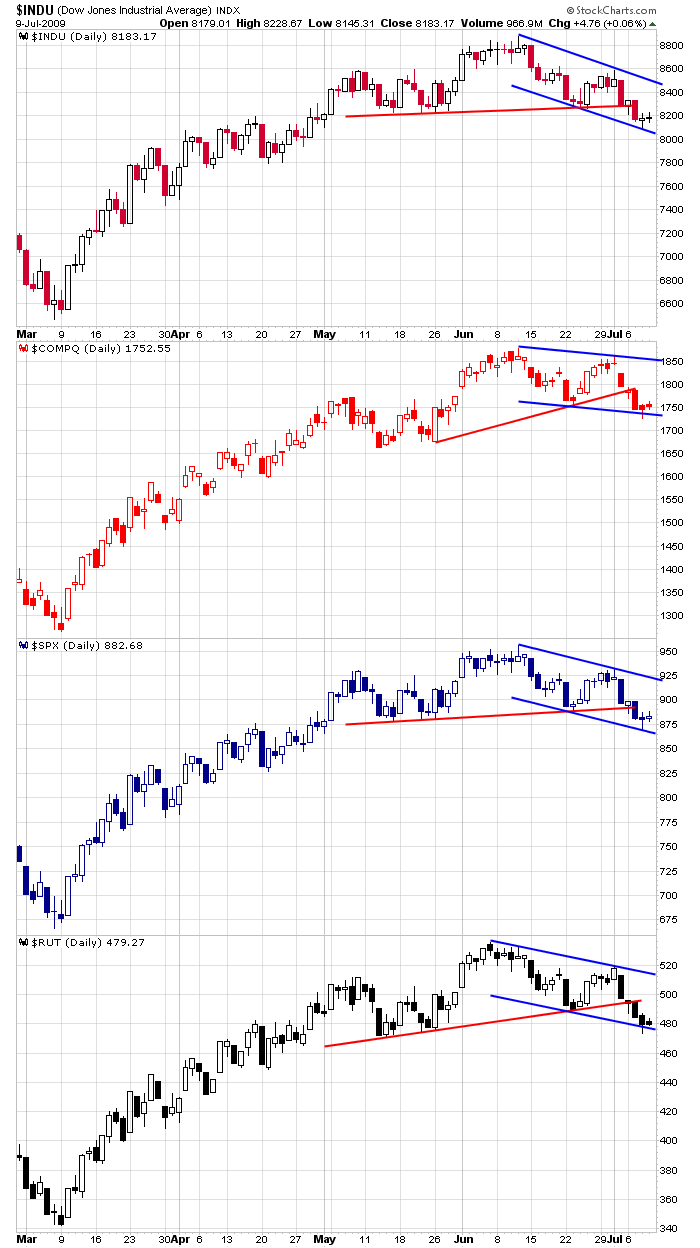

Here are those daily charts. They all traded through trendline support (red) and are now trading within what could be considered falling rectangles (blue) which have bullish implications. As long as lower highs and lower lows are the pattern, I’m sticking with the short side.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases