Good morning. Happy Monday. Hope you had a nice weekend.

I don’t have much to add to my weekend comments. I showed bullish and bearish versions of the daily charts and concluded that my bias remained to the downside because the breadth indicators were off their highs but still had room to move down before hitting oversold levels.

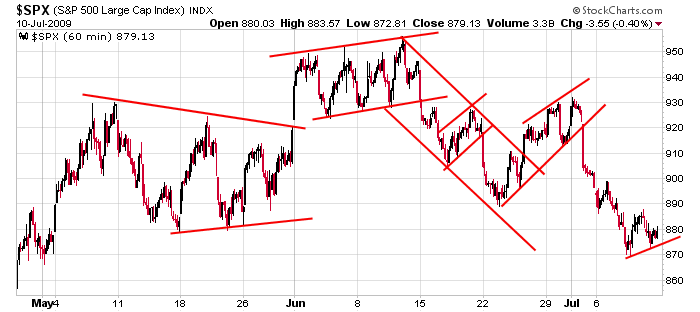

Here’s the SPX 60-min chart. Since mid June, the trend has been down; new 2-month lows were registered last week.

The Asian/Pacific markets closed mostly down today; Europe is currently mostly up. Futures here in the States suggest a gap up open.

Earnings season is here. Let’s see if companies that do well are rewarded or if positive results are already priced in…or if companies that don’t do well are punished or if negative results are expected. The market tends to act erratically the first week or so of earnings season and then settle into a trend.

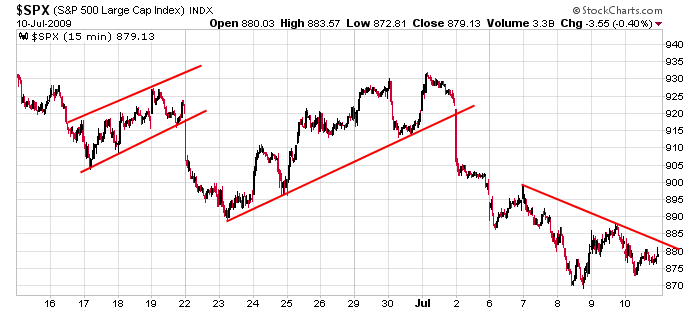

That’s it for now. Here’s a shorter term chart. If the market can move up, there’s lots of overhead resistance in the form of traders/investors who are hoping to “get out even.”

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases