Good morning. Happy Wednesday.

So the market rallied big on Monday in anticipation of Goldman’s earnings and now futures are up big premarket after Intel’s great numbers. Expectations had been lowered enough to make beating estimates much easier; that’s how Wall St. works. As the market falls, analysts downgrade companies and lower expectations. Then companies which are doing ok but not great suddenly beat those estimates. The market pops and the game continues.

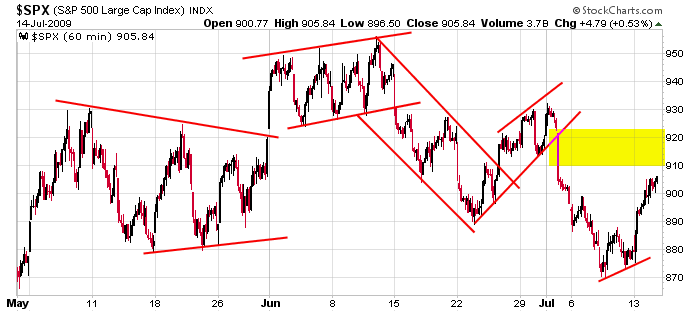

Those bullish index charts I posted over the weekend are looking more and more promising. There’s still work to be done…they have to breakout to the upside and forcefully take out the most recent high from within the pattern…but so far, so good. Here are those charts.

Here’s the SPX 60-min. If the futures hold their current level, the index will open in the middle of the gap.

Coming into today, the SPX is down 13.5 for the month. Futures are up 12.5. How frustrated will the bears be if the index goes positive for the month?

Yesterday I said it’d be small victory for the bulls if the opening gap could fill and then the market move up and close at the highs. It happened. Today I have the same thoughts although filling an 12.5-point gap is a little much if indeed the market was strengthening.

Play the good ones and play good defense. Trade what happens, not what you want to happen or think should happen. This is important. Don’t get caught trading what you think should happen or is supposed to happen.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases