Good morning. Happy Friday.

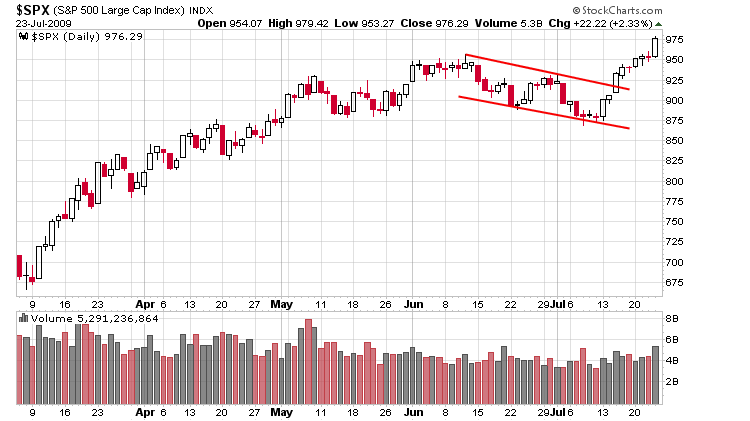

It’s been a heck of a week. Our bias has been to the upside, but we’ve been expected some backing and filling or at least some sideways movement before the next leg up began. Instead we got some chopping and churning early in the week and blast off yesterday.

Every index made a new high. Every index closed above its upper Bollinger Band (daily chart). The Nas 100 has moved up 12 consecutive days – I have no idea how often that has happened or if it has happened before. …

July is the one of the weaker months of the year – the SPX is up 57 points or 6.2%, and some very long term indicators – indicators which only flash a buy or sell signal once every couple years – are in the process of turning from sell to buy. I’ll cover them this weekend.

The SPX is up better than 100 points in less than 2 weeks. I call it idiot mode. It won’t keep going up like this forever, so be a little careful initiating new long positions – the risk/reward is not very favorable even though the trend is up.

Also, I’ve been saying for a few days the small caps and banks had to participate in the rally, otherwise the upside was limited. Yesterday the Russell led the market, and the banks did great too.

Here’s the SPX daily. If the move off 875 matches the move from 675 to 950, the target is 1150. I’m not expecting it – it’s just in the back of my mind. For now I’ll stick with the long side and play good defense.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases