Good morning. Happy Thursday.

We entered this week with our bias to the upside but thinking a little backing and filling was necessary to allow the market to regroup and ready itself for its next leg up. Instead we got follow through Monday and mostly range bound trading Tuesday and Wednesday. I guess sideways movement will have to substitute for a pullback because that’s all the market seems interested in doing.

The SPX and Dow rested yesterday; the Nas registered its 9th consecutive up day. Mathematically this is getting ridiculous. I can’t imagine this type of a winning streak being playing more than once every couple years. …

The Asian/Pacific markets closed mostly up. Europe is currently mixed and little changed. Futures here in the States indicate a moderate gap up open, but this of course can change in the next hour before the cash market opens.

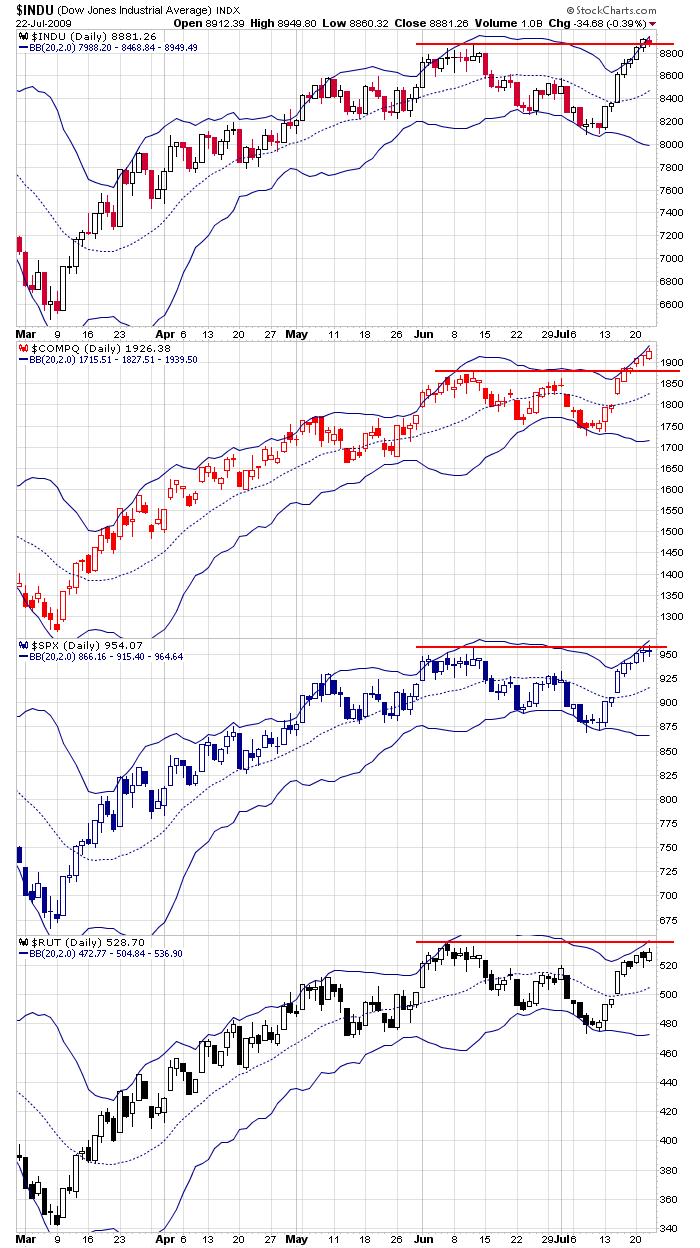

Here are the daily charts. In the last two days, the Dow, Nas and SPX have registered a new high and closed at a new high. The Russell small caps have lagged – something that should not be ignored.

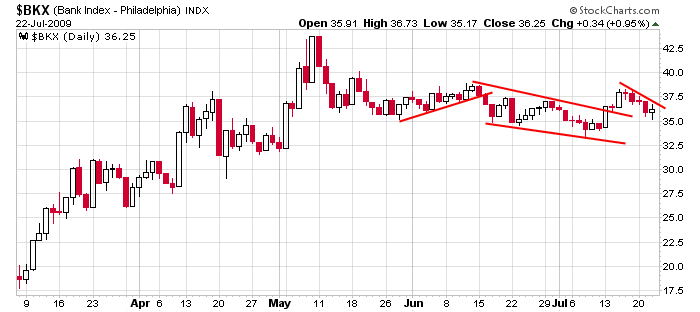

Banks have also lagged. This too should be a concern for the bulls. I don’t think the market has much upside potential without the small caps and banks.

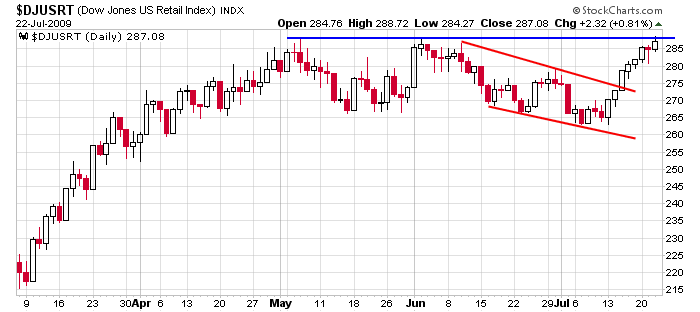

The unemployment rate is headed to 10% (it’s already there in 15 states), but somehow retail stocks are doing well. Hmmmm….

My bias remains to the upside, but I still think a little backing and filling would allow the market to restore some of its spent energy. If it surges from here, I question its upside potential. And if the small caps and banks don’t go along for the ride, I’d question the upside even more.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases