Good morning. Happy Wednesday.

Yesterday my hunch played out for all of half the day. The market gapped up…dropped to fill the gap…rallied and failed to take out the early-day high…and then dropped. But it only lasted until 1:00 est when a bottom was put in place and a rallied followed.

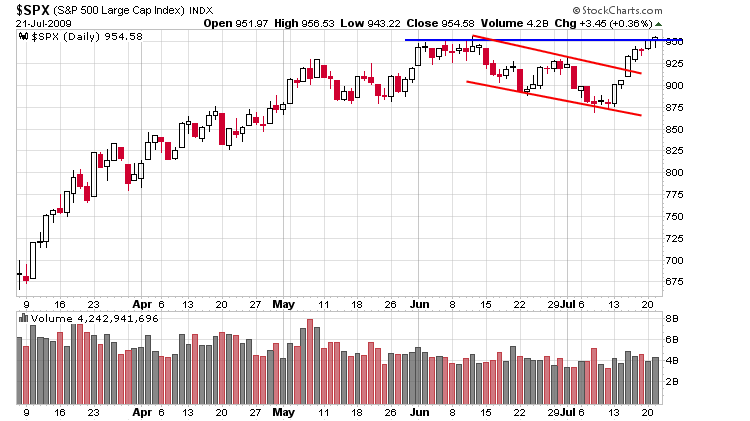

My bias is to the upside, but yesterday’s action would suggest the market is stronger than I think. After rallying 75 points in 6 days, the SPX couldn’t even give a little back. The Nas has now moved up 8 consecutive days. The Dow has moved up 7 consecutive days – the odds of this happening are teeny tiny. …

The Asian/Pacific markets closed mixed. Europe is mixed with a bearish bias, but there are no indexes that have moved more than 1% from their unchanged levels. Futures here in the States suggest a moderate gap down open.

My hunch today is similar to yesterday. Overall the charts are in good shape, so my bias is to the upside, but short term, I’m expecting some backing and filling. The market needs to rest before it attempts to leg up again. I’m looking for a gap fill or near gap fill this morning with an outside chance yesterday’s high is taken out (or close to it), and then I’d expect sellers to step up again. If we see weakness out of the gate, I’ll be looking to short the first bounce that follows.

Here’s the SPX daily. Yesterday it closed at its highest level since early November.

The Dow and Nasdaq look similar – new closing highs. But the Russell is lagging and the financials have not kept up. The market will go nowhere without the small caps and financials. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases