Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China, India and Indonesia gained more than 1%. Europe is currently trading mostly up; there are no big winners or losers. Futures here in the States point towards a flat open for the cash market.

The market dropped from just under 1300 to 1250 after the earthquake/tsunami/nuclear crisis played out in Japan, the S&P quickly recovered its losses. Volume was less on the way up than on the way down, but the points recovery was still impressive. So impressive that although I was interested in shorting a bounce last week, I’m less interested now. If the market either drifts sideways or if the bears can’t take back control while the indexes do some backing and filling, I’ll be more interested in buying a dip or playing a breakout than going short. But for now I’m mostly in cash and waiting for the market to reveal more of its intentions.

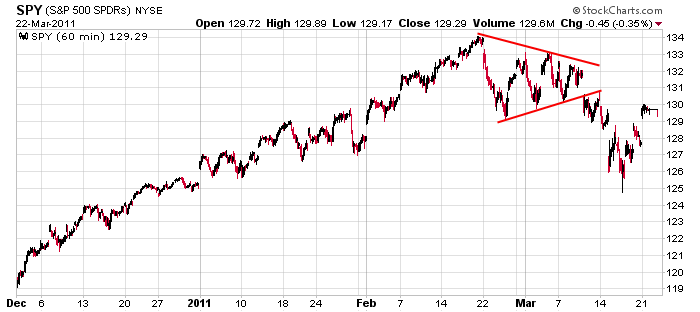

Here’s the 60-min SPY chart. There’s lots of resistance overhead, so the market has work to do. A continuation of the sideways movement or an innocent pullback would assist in an eventually rally attempt.

Be patient. I think the forceful move off the lows neutralized the negative sentiment, but we could still get a quick move in either direction because the market still very much news driven. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

6 thoughts on “Before the Open (Mar 23)”

Leave a Reply

You must be logged in to post a comment.

radiation good… buy buy buy

There is still at 50/50 chance of QE3. There an 86% correlation between stimulus and the S&P.(Guskin Sheff 3/23 letter). So, Be invested in indexes at least up to June ll, then watch for a possible change in Fed policy to continue to ease.

Voting today in Portugal, it could end the relative peace of EU debt fights.

Oh yow, watch the Saudi affair. Down on the tip to the south another strong man producing 274 BBl of sour crude a day is in deep trouble according to StratCom. Could mean 120+ crude.

Down again today for a while anyway. Still expecting a rally to new high before end of May.

Neal: that would be OptionsXpress ‘not’ Options Express HW

whidbey: Guskin Sheff is now a paid subscriber service as of 3/2011

So, please continue to post regarding same. Thank You, Howard NYC

Just bought some AMAT calls. Looking to scoop

up some ADM calls next. HW

Just bought some AMAT calls. Looking to scoop

up some ADM calls next. HW