Good morning. Happy Tuesday.

So the market couldn’t correct even just a little the day after options expire. I guess that means the market is pretty darn strong – or the correction will be delayed.

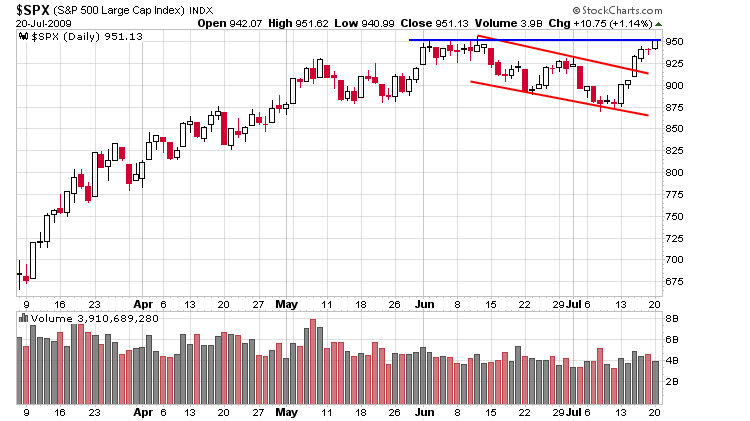

Here’s the daily SPX. We got a clean breakout from the falling rectangle pattern and now the index is at 950 resistance. Five of the last 6 days have been up; the index has rallied 75 points in this time period. How much further can it go before resting? Will it leave the gap just above 900 open? These are items I’m wondering. …

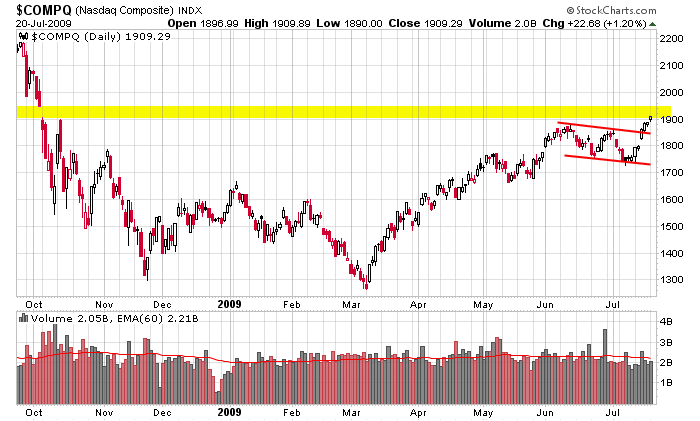

Here’s the daily Nasdaq. It’s up better than 20% in 2009 and is by far the strongest index. Trading just overhead is thin due to rapid drop and gap down in Oct.

The Asian/Pacific indexes closed mixed; Europe is currently up across the board. Futures here in the States indicate a likely gap up open.

In the back of my mind I’m wondering if we’ll get a false move up soon. Today would set the tone nicely…a gap up followed by a gap fill followed by a move up which fails to make a higher high…then we get a stiff down day. The trend is up; my bias is to the upside. But the market isn’t going to continue up at a rate of 75 points every 6 days. It’s got to do some backing and filling at some point.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases