Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed; there were no standout winners or losers. Europe is currently mostly down; there are no 1% losers. Futures here in the States point towards a small gap up open for the cash market.

Heading into this week I was looking for a little give back. My breadth indicators had reached levels not seen in a couple months, and volume on the move up was too light to suggest stocks were aggressively being bought up. Yesterday was mostly a dull day until the last 20 minutes when the bottom fell out. The closing numbers weren’t bad, but I didn’t like the end-of-day selling. If the market had drifted down all day, fine. But selling off into the close is a little odd. Let’s see if the market can right itself thereby shrugging off the selling pressure. Or maybe the selling pressure was a hint of things to come.

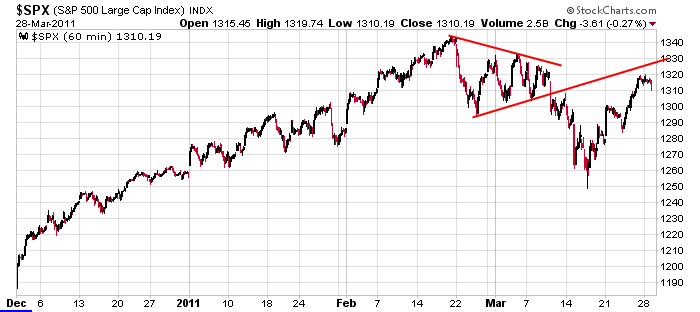

Here’s the 60-min S&P chart…nice 70-point move, but now the index contends with lots of overhead supply in the form of traders/investors wanting to get out even.

The recent move up was enough to neutralize the negative sentiment. Now the market needs some time off before attempting to move up again…if it wants to move up again. The next couple days will go a long way offering hints of the next few weeks.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 29)”

Leave a Reply

You must be logged in to post a comment.

As we come to the end of the month and the traditional

end of quarter window dressing, would somebody like

to share their thoughts about this. Thanks! HW

The news today is that the market had a fainting spell yesterday. What happened? It should have been a drive to the end of the month, but a couple of hours before closing they sold off.

I read this market as news driven (still) and risk off.

I think future rallys will be frail and investors should be careful,getting too many investments and too few stops preventing instantly dropping out is dangerous. I will use a few more options and a few leaps to move thru summer to fall. I show May24 thereabouts as a major top and maybe QE2 ends.

I have been looking for strong sectors for two weeks. I find none so far. Seasonally (historically) the RUT is probable to realize 3.8% in April. IWM or TNA for the plungers. But believe little and suspect all.

dumies get dressed up to look better and put in the window to show off

they will be sold at the april fools day auction

Today, Hertz (HTZ) is down in the pre-market due to insider selling.

You may want to take a look at some other stocks like Avis (CAR)

for a possible short. I know that this group in particular tends

to travel in the same direction, although I think Hertz charges

cheaper rates than Avis. Just kidding. Get it? travel in the

same direction? HW

if we cant make new highs and break yesterdays high piviot on dji-ndx-spx and it looks like we cant,,THEN these markets are going down

that will give the long onlys a nice april fools day

I can see 1 big down day on the horizon,

but then again so can everybody else. HW