Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed up solidly today, and Europe is currently up across the board. Futures here in the States suggest a moderate gap up open for the cash market.

Last week was the biggest up week since the bottom formed in early March. Coming in July when the internals were looking bad but not horrible was a surprise. But as we know, news trumps the charts. …

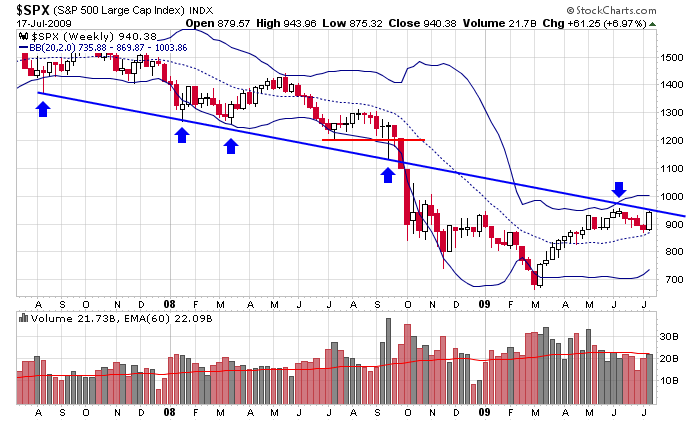

My bias is to the upside, but we’re not out of the woods yet. Here’s the SPX weekly. Resistance created by a significant trendline which has acted as both support and resistance the last couple years is just overhead.

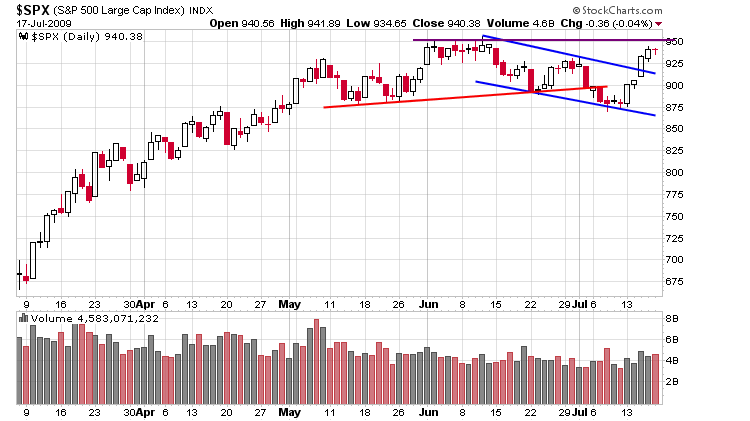

And here’s the daily. We got a clean breakout from the falling rectangle pattern but another resistance level is just overhead at 950. Expect some backing and filling soon.

If the market was strong…if the SPX wanted to move up and visit 1000, look for a little weakness early this week and then strength later. Strong markets are usually weakish early in a day and strong late and weakish early in a week and strong into the end of the week.

Research this weekend revealed a handful of decent set ups, but this is still summer and with out a dominant trend, I prefer erring on the side of taking profits quickly rather than letting trades fully play out. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases