Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up; China and Hong Kong gained more than 1%. Europe is currently up across the board; Germany is the sole 1% winner. 30 minutes before the employment numbers were released, futures here in the States pointed towards a moderate gap up open for the cash market.

Here are the numbers:

unemployment rate: 8.8% (from 8.9%)

nonfarm payrolls: up 216K (192K expected)

private payrolls: (will post when I get the number)

average workweek: unchanged at 34.3

hourly earnings: flat at $22.87 (0.2% gain expected)

The futures reaction to the numbers was positive.

The market continues to float up on light volume, and the internal breadth indicators support the move. The charts, which were messy at the beginning of the week are greatly improved, and sentiment has made an about-face. If feels like the Energizer Bunny market is back…it keeps going and going and going. Every little dip gets bought – whether it makes sense or not.

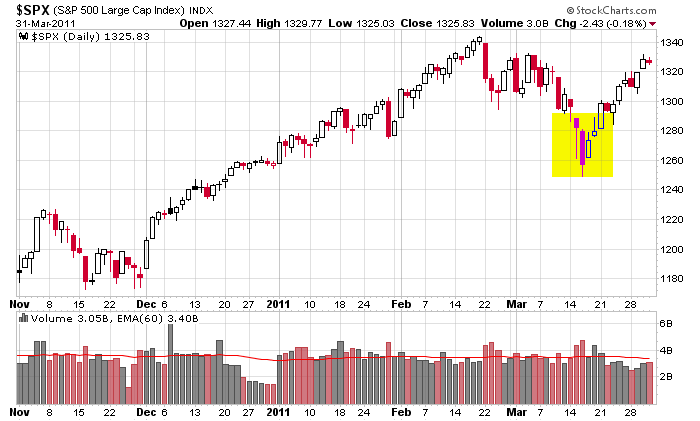

Here’s the daily S&P 500 chart. Other than a couple nasty down days (news induced) which were immediately reversed (see yellow box), the uptrend has remained in tact. The Russell and Dow are at their highs; the Nas and SPX are not far behind.

Trade what IS happening, not what you think should happen. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 1)”

Leave a Reply

You must be logged in to post a comment.

Definately happy, but maybe no buying until 1 hour in. Just wnat to see of the boat floats.

(#1) Aussie JS: What are your primary trading vehicles?

Given the fact that you use the 1 min and 5 min charts

one would think that you are severely limited as to

what you can trade given the above criteria. HW/nyc

Noah’s Ark will float at least for the first

two hours today even the though the weather

report calls for a 50% chance of rain. HW

Reprint at Howard,s request. Sorry Howard I’m just not an early bird.

Dow 13000 T shirt ideas:

1. A hot air balloon with the gondola made of dollar bills on fire.

2. A bull pooping three 0 shaped cow pies with flies forming a 13 and his tail pointing up. Caption, “Moo, moo, dow”

3. A printing press spewing out dollar bills that form 13000 in the air.

4. 13000 forming stepping stones between America and the rest of the world.

5. Start with a Hoooters Girl T-shirt, felt pen and your imagination.

How lucky can a guy get with 13,000 written

all over his shirt. Wait a God damn minute!

I just thought of something…how about a

tatoo on your pecker…..Dow 13,000 Yipes!

What would you have the women tattoo and what is a, “God damn” minute? Is it longer or shorter than a reqular minute? I’m not sure I’d want a minute God damned.

Howard,

i trade the ftse-dax-spx-dji-ndx-xjo-n225 futures on the 1 and 5 min charts,which inc the live nytick ind on both and other live inds–not laging

i am a red indian and take scalps

may be it will \turn out to be april fools day–may be not but a long range reversal day would be good as i have just gone short –how long for depends on how many 15 min traders push me into profit

(#2) Aussie JS : Looking at the VIX, it looks like

we might be setting up for a sell signal. Of course

I haven’t booked fantastic profits like you, so I

will be prudent and wait for confirmation before

I go short. I forsee a ‘pullback/profit taking’ in

the final hour of trading today. HW

oops–my joke about being a red indian may be in bad taste on a usa forum

i was only in the dax for 15 min for 10 points profit,but could be still in it if i wanted to –its futures close when usa does

anyone want to know whats keeping us up today–look at the euro–it sold of on the jobs report,then the central banks jumped in sending it up to 142

central banks still control the markets

i use the euro and usd as indicators on 10 min charts–sometimes they are corrolated

(#3) A//JS:funny thing..some numbers came out today at 10am

eastern. It almost seems like the big instos and big boys already

know what’s happening and are just slightly ahead of the curve

for each and every trade. Now a little guy like me trying

to day trade: I use the 1 min chart for the first

2 hours of trading and then the 5 min chart for the

balance of the trading day. HW

Oh yeah, one more thing. I would like to see the

Russell 2000 at least 2x stronger than the rest

of the indexes. So, potentially we ‘could’ see

a sell off later on in the day. HW

Hey Aussie J

oops you’re joke not too bad….considering the yanks still believe kangaroos’ hop dowm George St…. ; }

Coming up your way soon from the Gold Coast…maybe we could meet for a Schooner ?

Hi Jay

that would be good–let us know when—im a ex sydney boy myself –born in ashfield