Good morning. Happy Friday. Happy Options Expiration Day.

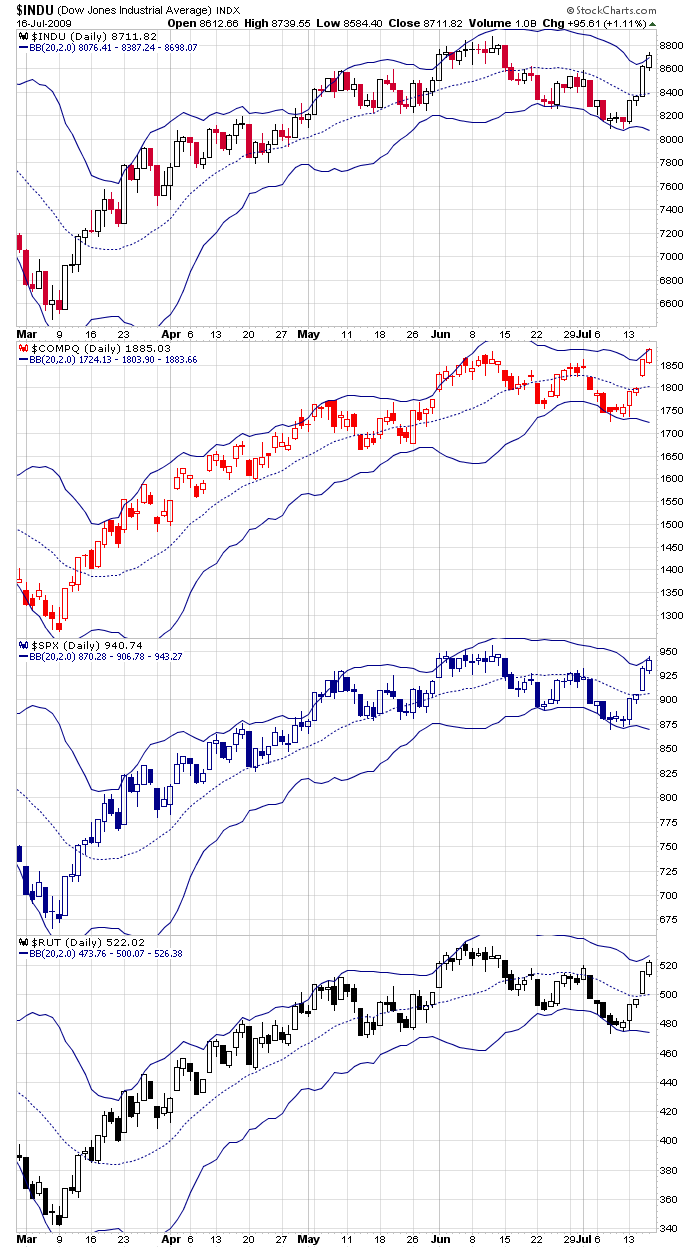

Those bullish index charts I posted over the weekend when we were considering both the bullish and bear possibilities are certainly playing out well. The Dow has cleanly broken out…the Nasdaq has already taken out its June high…the S&P is only 16 point from its own new high…and the Russell isn’t doing too badly either; it cleared resistance at 520 yesterday and now needs some follow through. But now the indexes are up against their upper Bollinger Bands on their daily charts, so odds favor a rest coming soon. Here are the charts.

Another trend worth watching involves the price action before and after options expiration. The trend isn’t as strong now as it was last year when the market typically rallied into OE and then sold off after. This is something to be aware of early next week.

GOOG topped Wall St. estimates but posted very little revenue growth due to less online advertising. The stock is down 2% before the open.

BAC and GE also topped expectations but are trading down.

The Asian/Pacific markets closed up…Europe is currently mixed with a bullish bias…futures here in the States suggests a moderate gap down open. This comes on top of some late-day selling yesterday. As of today’s open, half of yesterday’s gain will be gone.

It’s Friday; it’s summer. The trend coming into this week was down, and now it’s up. The charts, which take time to set up in tradable patterns, are a little messy. Play good defense and be open minded. Anything goes for next week.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases