Good morning. Happy Monday. Hope you had a nice weekend.

The market got into idiot mode late last week. It kept going up and up and up no matter what news came out. Individual stocks were punished for not announcing earnings up to Wall St’s expectations, but the overall market was not negatively effected by bad news.

The Nas and Nas 100’s long winning streaks have ended, but that’s hardly an issue. The SPX is now up 60 in July, so it’ll take a lot of steady selling the next couple days to close the index down for the month. Not bad considering July is one of the weaker months of the year. …

As has been the case during the entire rally off the Mar lows, the expected doesn’t always happen….what should happen doesn’t….what makes sense doesn’t always play out….and when the gov’t is heavily involved you never know what’s going to happen. The trend is solidly up, and the indexes are into a thin trading zone created last fall when they rapidly dropped. I’m not going to predict whether the entire thin area will be filled (the SPX would have to get to 1200), but the trend is solidly up. Our job is to go with the flow.

Having said this there’s a little too much fluff out there…the market needs to correct, even if it only happened temporarily. The risk/reward for initiating new positions is getting less and less favorable the higher the indexes go. And the banks have been lagging; they need to catch up or else the upside will be capped.

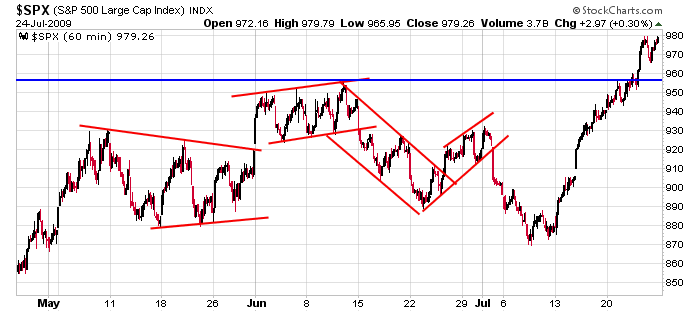

Here’s the 60-min chart. New high territory and very little to work with regarding potential support and resistance levels.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases