Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed – there were no big winners or losers. Europe is down across the board. France and Norway are down more than 1%. Futures here in the States point towards a moderate gap down for the cash market.

The market has averted a disaster the last two days by bouncing intraday. One of these days the market may not bounce. It’ll open (up or down) and start selling off, and the selling won’t stop until the closing bell. It could happen any day.

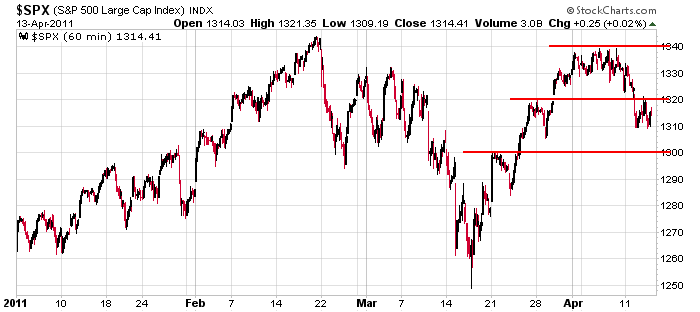

Here’s the 60-min S&P chart. As of now the open will be just under 1310. The next downside target is 1300.

I’ve been laying low this week. I didn’t add many set ups to the trading lists over the weekend and still don’t see much worth playing. The overall trend is; the near term trend is very much in question. Make sure you’ve clearly identified what pitch you like to swing at…and then be disciplined to only swing at those pitches. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 14)”

Leave a Reply

You must be logged in to post a comment.

Jason must have taken one of those study at home sales training

courses because one of the sales techniques that is most often

used is called, ‘switch the pitch’//As long as POMO stands

grounded in their efforts to hold the line, I don’t think

we’ll see a wipe out in the markets. I do think however

we could see a disgruntled US govt employee who is so

fed up with the system could give an exclusive interview

to ABC news (in disguise, of course), about the way things

are really done in the underground bunker at the Fed. HW

the fed is only a small part of the game –its all the other copy cat central banks with their qe2’s—but they are all failing

the game is not and never has been about the bulls/bears–its about the instos verses the retailers and the retailers are useually the long onlys

the only thing holding the market up today is the ndx,but it will sucumb with a break of its low

Seasonal sell, go away? No, shorts and dividend stocks. The cycle

is down now thru 2017 or so. Dividends and stocks purchased at

lows will be good for 2020 and after. Oh, Bonds are shorts, big time.

The EU situation is awful and still the Euro climbs on the dollar.

Our associates in London say there is serious concern over the

US fiscal situation. Include me in that. What is next? No new

debt ceiling? Dollar collaspe? Be ready for the unthinkable.

Whidbey? The unthinkable? How about President Obama runs

across the White House lawn in the buff. You know we

used to call that streaking in the 1960’s. HW

Howard in the 60s we did such things

at Stanford, but today it would not

considered shoe. Never mind.

Neal,

Where are your posts on Richard Russell?

Is Dow Theory still a valid thesis ?

Comments on the SKEW index please. I’m not sure how to use it.

If you want to personally attack me, do it somewhere else. Otherwise you won’t be welcome here.