Good morning. Happy Wednesday.

We entered this week with the trend being up but not crazy about initiating new long trades given the risk/reward wasn’t very favorable. So far, we’ve gotten 2 days of range bound action and very little overall movement. The situation hasn’t changed. The winning streaks have ended, but the trend remains solidly in place.

The Asian/Pacific markets closed down…Europe is currently mixed with an upward bias. Futures here in the States suggest a moderate gap down open, … but this could change in the next hour.

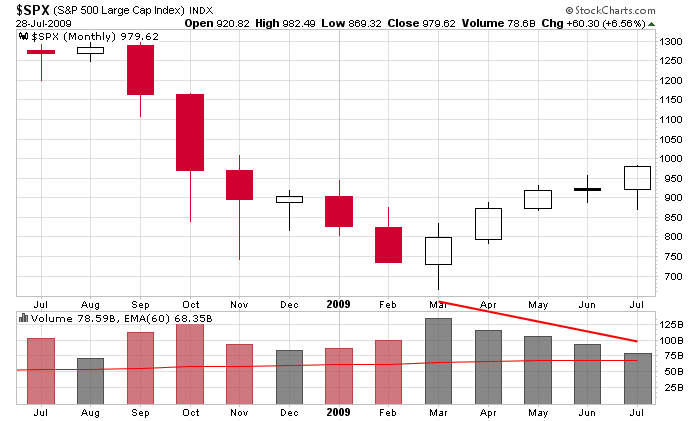

The SPX is up 60 points this month, so barring a massive sell-off the next 3 days, July will be the 5th consecutive up month. Not bad considering it’s one of the worst months of the year and 3 of these 5 months have fallen in the “sell in May and go away” period. Volume has declined, and I’m not sure what to think about that. Volume should equate to votes…the more volume, the more traders/investors are voting in favor of a move. But so much of today’s volume is computers trading back and forth with each other, I’m not sure if the volume numbers are as telling as they once were.

Here’s that monthly chart.

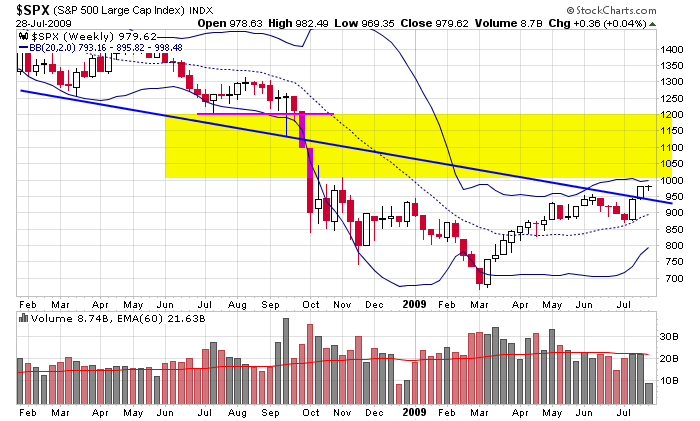

And here’s the weekly. The index traded through a significant trendline and is now within 25 points of the psychological 1000 level which happens to be the top Bollinger Band too. If I was a betting man, I’d say the index pokes through, gets bulls even more exciting, breaks the backs of the bears and gets the media ecstatic. Then the market will correct.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases