Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down – Australia, China, Hong Kong and Japan lost more than 1%. Europe is mostly up – the Stockholm and Swiss markets are up more than 1%. Futures here in the States suggest a positive open for the cash market.

The market got hit hard yesterday after S&P lowered its outlook on the US’s long term debt from stable to negative. Everything moved down, but the closes were off the lows. It was bad, but it easily could have been worse.

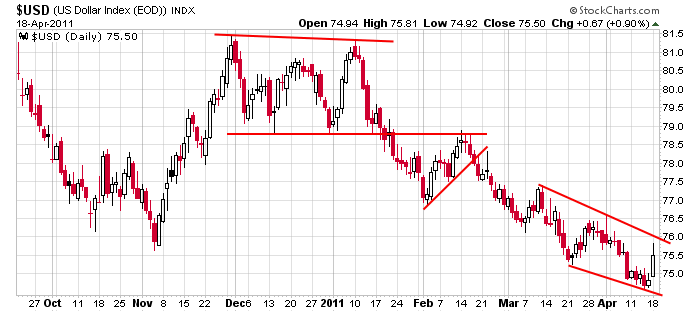

The change in outlook means there’s a 33% chance the US will lose its AAA rating, which would result in having to pay highest interest rates on their debt. The dollar responsded with one of its biggest up days in a couple months. Here’s the chart. A falling dollar helps push stocks higher; a strengthening dollar has the opposite effect.

The market is not looking great here, but it hasn’t completely fallen apart. It’s absorbed a lot of bad news the last month and has held up very well. Our list of good tradable set ups is not big – there really aren’t many good patterns out there, so for now, I’m maintaining my conservative stance because I have no problem waiting for better circumstances. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 19)”

Leave a Reply

You must be logged in to post a comment.

I love your stuff. One small point on the USD market corellation. That’s the way it has been been in this market, this time frame. Not all markets respond that way. In other time frames, when domestic consumptation is more a driver for economic engines it can be the other way around. That is a rising dollar and market occur at the same time. The mid 80’s come to mind. In the end, you’re correct, for now.

You’re right Bob. They’re not always inversely correlated, but right now they are. When they get divorced, I’ll make the adjustment.

The debt ceiling looks formatible

for the near future. The little

message from S&P was not a shock

but I am betting nothing has changed

in the White House or Congress, spend as

usual. Bond flight winnings are good, and

the PM continue. The Goog play is closed and

I am out of my AAPL short. Looking for

some more shorts this earnings season.

On Friday the 30 min and 60 minute charts suggested

that we would have a strong follow through on Monday.

So for me, anyway, yesterdays 200 point drop caught

me by surprise. I think for this short holiday week

I am not going to play and try hero because anything

is possible. Oh yeah, one of the CNBC reporters

just moved in to a new Condo next door. She works

side by side with Larry Kudlow at 11am eastern. HW

My CNBC babe goes on in 20 minutes with Larry.

If she says something about E93rd St NYC maybe

she’s trying to send me a secret message. HW

What else does a falling dollar do?

ill be loading up SHORTLY on some retailer bulls

Geez Neal–You always ask Dumb Q’s Re: Australia !!

Nearest Railway Stn is TSV;& get off the blooming Boomerang !!