Good morning. Happy Thursday.

I see the front cover of Newsweek magazine says the recession is over. I’ll have to run out to a magazine rack this weekend and see who else says the worst is over. Magazines are notoriously bad at these types of things. They are typically super bearish near bottoms and too optimistic at tops.

The market has spent almost 5 full days in a tight range. I consider it a pause within an uptrend, and the longer it lasts, the less necessary a correction is. After 12 consecutive up … days for the Nas 100 and a 100-point gain for the SPX during that same time period, the market needed to do some backing and filling. But the longer it moves sideways…well, you know.

Except for Taiwan, Asia/Pacific closed up across the board. Europe is currently up across the board. Futures here in the States suggest a moderate gap up which will open the market above the recent highs.

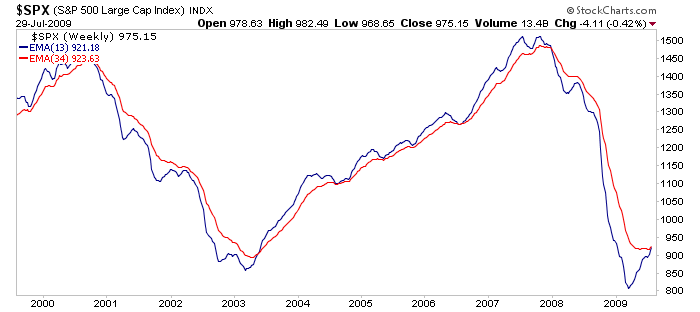

Even though it’s summer, the market feels like it’s at a critical juncture. Sentiment is much improved; expectations are growing, and longer term indicators are starting to flash bullish signals. Here’s one I got from John Murphy several years ago. A simple cross of the 34 EMA by the 13 EMA on the weekly chart has captured the bulk of the large swings the last 10 years. We are very close to a cross right now.

Do we get a blow-off top? Do the lows need to be tested? Can the gov’t really just print enough money to support the economy without there being real organic growth? I don’t trade charts like the one above because my focus is on much shorter time frames, but I do like to keep them in the back of my mind.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases