Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. India lost more than 1% while Japan gained more than 1%. Europe is down across the board. Austria and France are worst off. Futures here in the States suggest a moderate gap down open for the cash market.

The European Central Bank kept its key interest rate unchanged at 1.25%.

The CME again raised margin requirement on silver. This is the 4th raise in two weeks and it pushing silver prices down again.

The market has certainly taken a turn this week. As good as the charts looked on Monday morning, 3 down days plus a gap down today have gotten everyone’s attention. Will the bears finally get a sustained pull back, or is this just another mini correction within one of the best rallies in history? We never know the answer until after the fact, so our job is to manage trades based on the odds, and then let things fall into place. I wrote Monday during the day you do not want to stay long unless you considered yourself a long term trader. It was best to step aside and buy some reverse ETFs to make some money as prices settled down. Whether they settle down for a day, a week, a month or longer wasn’t something we knew. Our job is to position ourselves appropriately and then manage our positions.

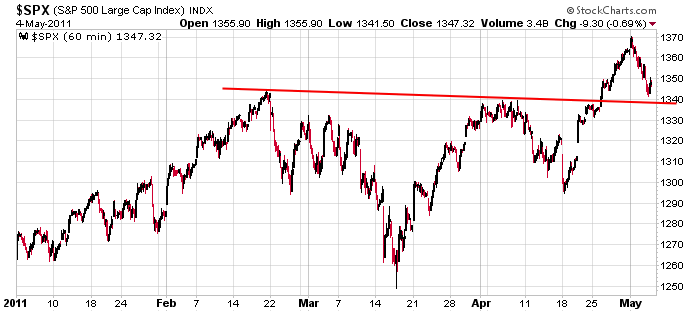

Here’s the 60-min S&P chart. There’s nothing hugely wrong with it. We got a clean breakout near 1340, a rally to 1370 and now a pullback to test the previous resistance level. I’m a shorter term trader, so Monday’s gap up and selling pressure was enough to get me out of my longs, but if you’re a longer term trader who is willing and able to sit through some pain in exchange for being positioned to nail some bigger moves, you could justtify holding here…but only if you’re a longer term trader.

For now I sit in my reverse ETF positions and continue to monitor things. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Economic Numbers

0 thoughts on “Before the Open (May 5)”

Leave a Reply

You must be logged in to post a comment.

And April 30 was 2/8ths of an Armstrong cycle of 8.6 years from Mar 6 2009.

That is the normal first leg up.

Thanks I will look at this.

todays move down just now to to 13325 in the futures spx ,which is also a previous close

is low enough and ideal for a failed rally–the rally can last a few days and take us close to the top,or just be today

1332 in futures ,equates to 1337 cash price, allowing for fair value

Good to hear.The 475,000 first time claims makes

it sure that SP moves to and through support, 1341 is critical.

As for SLV, when buyers sell the Trust must also sell and that is the

way it goes for a time yet. But one day SLV will stabilize

and move to 60. Nervous over the debt ceiling looks like a

train wreck brewing.

I suspect the Fed will pump harder to avoid a wipeout,

at least, ECB did not raise rates again.

In 1987 the first leg up based on “fixed” dates coincided with the the crash day.

I see great parallels here with 4 days down into the 1989 mini crash.

Who wrote the Pattern Trapper? I could do EOD. Don’t have the resources to give to Day Trading.

Well I have two things to say about the Fed. 1. they are ready to put more gas into the tank as necessary 2. the Fed will try very hard to protect their investment in both QE1 and QE2.//I was listening to Jim Rogers in the middle of the night on CNBC (you can catch some of his comments on the CNBC website), and the thought about Congress balancing the U.S. budget is just a far off dream, and that they won’t do anything about it until it hits crisis levels. As for Max he is resting comfortably on the sofa. Should I get him a companion, perhaps? A playmate he can mate with while I am out drinking coffee at Dunkin Donuts. HW

Neal –the Pattern Trapper inds are great for intraday and short term stuff ,but wont work on longer term –im nearly sure–ask ur friend there,if he says they do ill take the course on my card

my prob is that im on esignal and my charting computer has 2x 24 inch monitors with 10 charts open side by side with all my live propritory inds

Your pointis?

They don’t work for you I guess.

Been brilliant for me but am a child of the’60’s , lol.

the weiss group has a training program for bears–both my pet bears –teddy and grizelly have done the course

look at all this nice upside im missing ,because im to stubbon to go long,

but did get all the short side from when Howard was watching t.v at europe open

go the ndx it should hit y/days high and i may reload

anyone notice the usd and euro–the carry trade is coming off on ecb interest rate hold

markets to choopy even for me –going to sleep

my telepathic sences woke me up for the reload–dosnt take long to hit the down does it

flat now—prob more to go down but im sleepy

Neal–i’ll email Bob

The Armstrong Cycle !…Is that named after Neil or the Child that Jimi & Janis were going to have in the ’60’s after ‘doing it at Haight-Ashbury ?/?