Good morning. Happy Friday.

Payroll numbers are out. The unemployment rate has jumped to 9.4% from 8.9%. The expectation was a jump to 9.2%. Doesn’t seem very good, but the number of newly unemployed was less negative than expected (-345K vs. -520 consensus) and last month’s figure was revised down from -539K to -504K. The market’s reaction to this new is very positive. Futures spiked higher, and if the gains are held, we’ll be opening at new swing highs.

The unemployment rate is the worst it’s been in 25 years, but the number of newly unemployed is the fewest since Sept. Since the market is forward looking, and employment is a lagging indicator (companies start hiring after the economy starts to rebound), the excitement in the futures market is in anticipation of better things ahead – even if today is still painful for many.

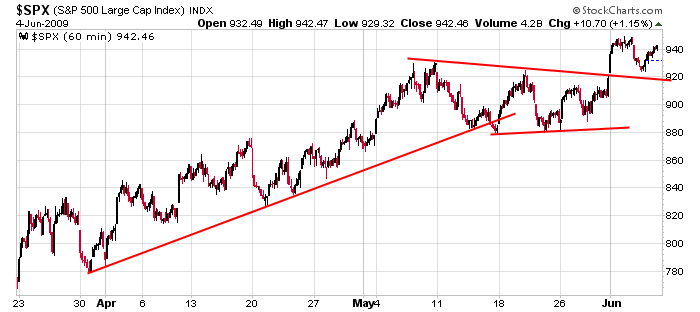

Here’s the SPX 60-min chart I’ve posted several times. Pretty simple. There is nothing wrong with this picture. If you want to be less bullish, fine, but I see no reason to be bearish.

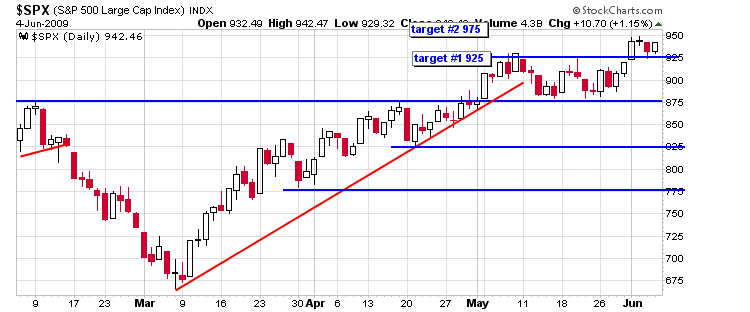

Here’s the SPX daily I posted at the end of April. The first target was hit quickly. Target #2 remains in play.

Watch out for a gap and crap, and have a great weekend.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases