Good morning. Happy Thursday.

The market gave a little back yesterday. It’s not what I wanted to see, but it is what it is. Given Monday’s breakout, I would have preferred some more upside movement so we could get some separation from the former resistance level. Then the move would have looked like a more traditional breakout rather than a continuation of the higher highs and higher lows pattern. Volume did fall off for the forth consecutive day.

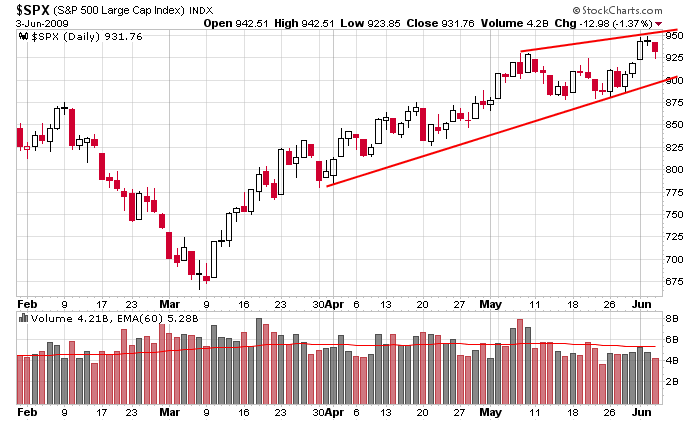

Here’s the SPX daily. The uptrend continues. The trendlines are converging which makes this more of a wedge than a channel, but I’m not too concerned right now. As long as 900 holds on a pullback, my bias will remain to the upside.

60 min before tomorrow’s open the unemployment numbers will be released. It’s expected the number climbs over 9%, so the scene is somewhat set up for a positive surprise. In any case, a bad number shouldn’t be a shock.

The market is more likely to be slow than anything today because traders usually aren’t very willing to place big bets or press the issue ahead of a potentially market moving item. For day traders, this means a strong early rally is probably shortable just as a sell-off being buying. For swing traders, manage positions individually. If they’re holding up well, keep them. If not, dump them and move on.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases