Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down; there were severel 1% losers. Europe is currently down across the board; half the markets are suffering greater-than 1% losses. Futures here in the States point towards a moderate gap down which will put the indexes at or below yesterday’s low.

The dollar is up futher, and commodities continue to take a beating. Oil is down better than 2 bucks and silver is getting crushed.

The market is in a very fragile state. The overall index charts don’t look too bad – it could be argued they’re consolidationg within an uptrend – but we can’t wait for a confirmed downtrend to change our stance. I sold my longs on Monday, May 2 and bought reverse ETFs. Then I sold those ETFs last Thursday. I was hoping for more upside to re-enter those reverse ETFs, but no such luck.

Trading has been a challenge lately. Over the last month the market has gone up, then down, then up, then down, then up, and now down. There is no net change, just some up and down movement that could only be capaitalized on if you traded short term.

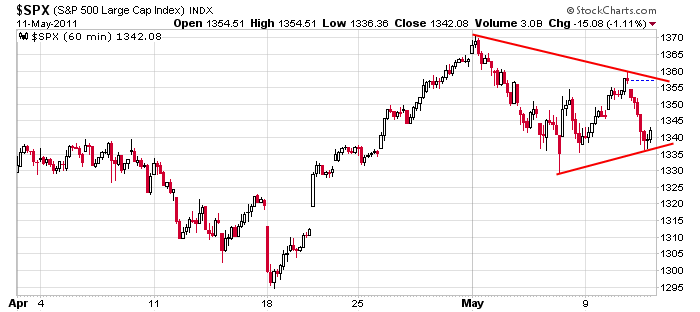

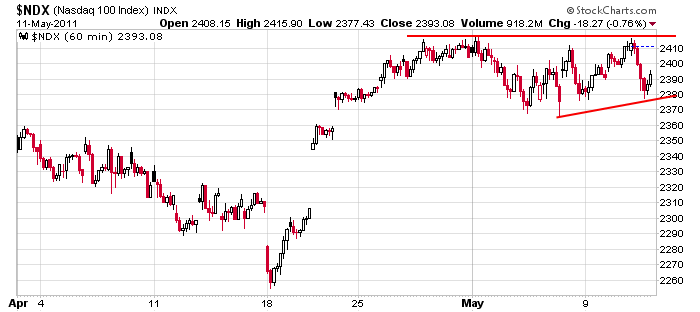

Here are the 60-min SPX and NDX Charts. They don’t look too bad.

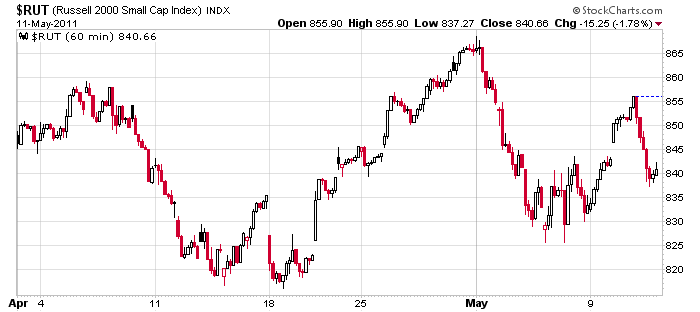

But here’s a problem. It’s the 60-min RUT. It didn’t rally to the same extent at the end of April, so instead of easily taking out its early-April high, it barely took out the high. Then the early-May drop was much greater than seen in the other indexes. Overall instead of a consolidation pattern within an uptrend, we have a neutral index – not good since the small caps lead.

As I said yesterday, I am not looking to go long right not (I’m not buying breakouts or dips). The market has some proving to do first. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 12)”

Leave a Reply

You must be logged in to post a comment.

Election year 3rd in Presidential cycle. The money

will come into the economy to elect someone. For those

who both trade and invest, this market is going to be

a buy this summer.

the banks may not have enough money to elect a govt–perhaps they could ask uncle ben for a loan

Jason, I often have traded the index spreads (ES/NQ, EMD/TF, etc…) over the years and valuation of the small caps vs large or even tech has been a decent play. For the Russell to not exceed its ALL TIME HIGH while SPX and NDX were hitting those recent highs, I do not feel, should be given as much concern. just my two fiat cents of an opinion…

whidbey – forget the Presidential cycle. The bigger issue on this site is the voting to determine if Neal continues to post on this site. As you may already know, it’s a vote for Tony or Neal and the deadline is tomorrow. Get your votes in or forever hold your tongue.

Howard – see if Max is eligible to vote. I don’t see why not, as he has been part of the dialogue on many occasions. Here’s hoping for a large turnout at the voting booth.

There’s no sense in looking at charts, technical indicators, etc today. Wall Street is selling on the FED’s instructions. I’m meeting with Chuck (Plosser)next week to try and find out the time frame for DOW 13,000. Until then, buy one of Neal’s publications or subscribe to one of his trading services, or buy his software or at least check out his website.

Neal for president

Tony to run the fed

Aussie JS – No fair! Neal wants a vote either for him (to continue to post on this site) or for Tony (described by Neal as “little prig” – affectionately I presume. Neal is counting the votes so you must be clear with your vote, Aussie JS. I have implicit faith in Neal that he will conduct the vote count with honesty & integrity.

as a Aussie ,i cant vote in american politics,but i wish both candidates a good ,fair and clean battle—-no pork barreling

Neal wishes to inform us that he is mad at the whole world

for some reason (I think his teenage daughter is giving him

a hard time), so he will be back for more abuse when he is

ready to chat some more. As for myself, Jason is very keen

on the idea of watching the Russell, as that will give you

the lead one way or the other where we are headed next

short term.

Jason usually makes good sense – at least to me.

Howard – see if you can get Max to vote. It’s the American way. I’m disappointed that Aussie JS will not vote in a matter as important as this. I’m beginning to think no one cares if Neal posts or not, much less what he has to say. Come to think of it,does anyone care what any of us has to say on this site (Jason notwithstanding)?

I’m an Aussie and I ( I might add eloquently)voted YESTERDAY !