Good morning. Happy Wednesday.

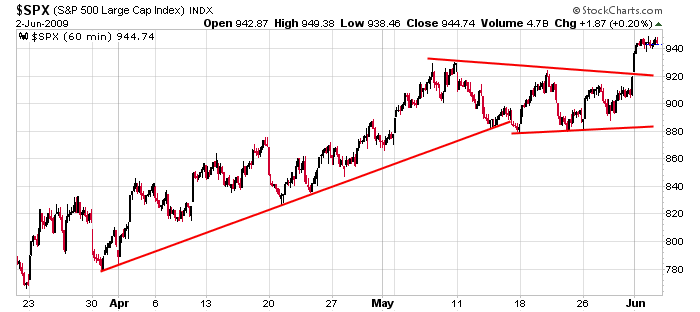

So far this week we’ve had a 1-hour uptrend on Monday morning and 12 hours of sideways, range-bound trading. Overall the charts remain in good shape. We got clean breakouts on Monday, but it’d be nice to get some follow through and separation from the former resistance levels.

Gary jokingly asked yesterday on the message board what percentage of days the market closes at an extreme (either intraday high or low). Using the S&P 500 emini futures contract to crunch the numbers, here are the results.

The percentage of time the ES closes within X% of the HOD or LOD:

13% of the time it closes within 5%.

26% of the time it closes within 10%.

37% of the time it closes within 15%.

48% of the time it closes within 20%.

59% of the time it closes within 25%.

So the ES closes within 20% of its H or L 48% of the time…so if the range is 16 points, there’s a 48% chance it closes within 3.2 points of the H or L.

If you’ve noticed we often get an end-of-day move into the close, don’t be surprised. It happens often. In fact it happens often enough that a day trader could make a living focusing only on the late-day movement.

Moving on, here’s the S&P 60-min chart. Other than Monday morning’s unfilled gap, this chart looks great. Don’t over-analyze the market. The intermediate term trend is up.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases