Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

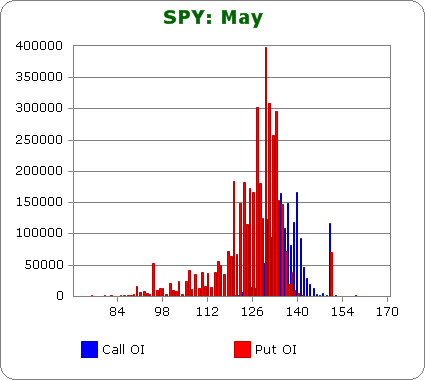

SPY (closed 133.19)

Puts out-number calls 2.4-to-1.0 – bearish but much less bearish than last month.

Call OI is highest between 131 and 141.

Put OI is highest between 120 and 135 with the biggest readings taking place at 127, 130, 131, 132 and 133.

There’s some overlap between 131 and 135, but since puts far out-number calls, expiring the puts worthless would cause more pain than trying to expire most of the calls and puts worthless. Hence a close between 133 and 135 is needed. With today’s clost at 133.19, flat or slightly up trading the rest of the week would do the trick.

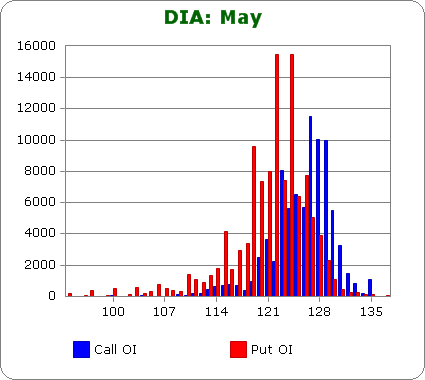

DIA (closed 125.47)

Puts and calls are about equal – last month the numbers were 2-to-1 favoring puts.

Call OI is highest between 123 and 129.

Put OI is highest between 119 and 126.

There’s overlap between 123 and 126 and an obvious break between the highest open interest call and put strikes. A close in the middle – somewhere between 125 and 126 – would cause the most pain. With DIA closing at 125.47 today, flat trading is needed.

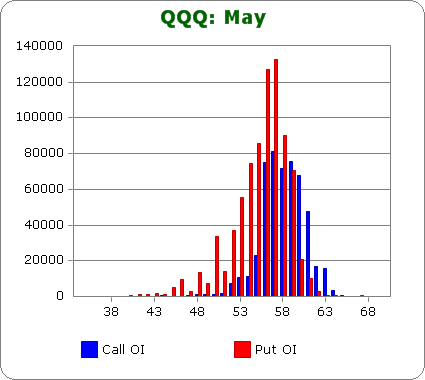

QQQ (closed 57.40)

Puts out-number calls 1.7-to-1.0 – bearish but less bearish than last month.

Call OI is highest between 56 and 61.

Put OI is highest between 53 and 59.

There’s overlap between 56 and 59, but since puts out-number calls and the put OI at 58 and below is higher for puts than calls, a close near the top of the range (58ish) would cause the most pain. With today’s close at 57.40, flat or slightly up trading the rest of the week is needed.

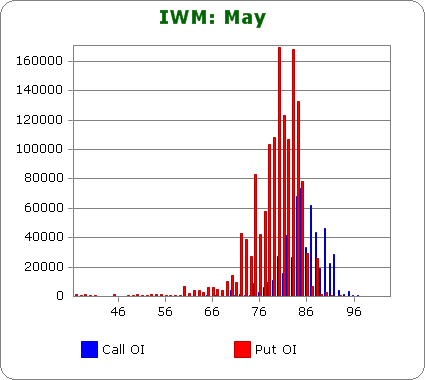

IWM (closed 82.29)

Puts out-number calls 2.8-to-1.0 – bearish but less bearish than last month.

Call OI is highest between 84 and 88.

Put OI is higest between 78 and 85.

There’s overlap between 84 and 85, but the overlap hardly matters considering how much greater the put OI is. A close above 85 would cause most puts to expire worthless, and with today’s close at 82.29, a move up is needed. If IWM closed unchanged the rest of the week, a couple put buyers would make money.

Overall Conclusion: The put/call numbers were not as bearish this month as they’ve been in previous months, and surprise surprise the market has been weak. Funny how that works. 🙂 The stats this month tells us flat trading the rest of the week would cause a lot of pain, but a move up the next few days would cause more pain.