Good morning. Happy Tuesday.

We got across the board breakouts yesterday from the indexes. A two month rally was followed by one month of consolidation which has now been followed by a breakout and new swing highs. The charts look very good as we enter the stretch of the five worst months of the year.

Volume was strong. This is certainly what we want to see on a breakout, but it’s also something that could lead to a blow-off top – a last ditch effort by the shorts to cover and bulls to join the party. I’m not predicting such a scenario, but it is something that’s in the back of my mind. Follow through over the next couple days would go a long way to solidifying the breakout.

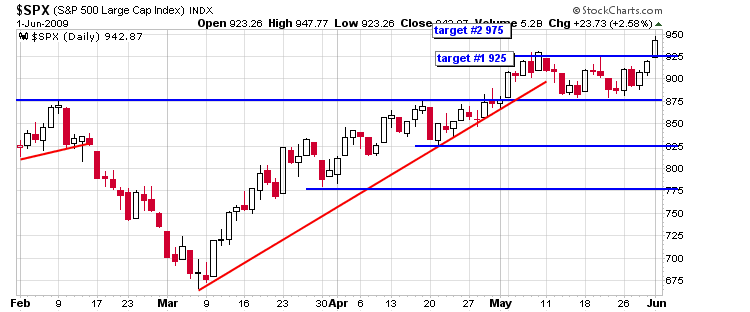

Here’s the daily SPX I posted at the end of April when it was flirting with breaking out at 875. Target #1 was hit within a week or breaking out. Target #2 is now in play.

If you want to be less bullish today than you were two months ago, that’s fine. The market has rallied huge off its low, so there’s less meat on the bones now. But there’s no reason to be bearish.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases