Good morning. Happy Friday.

I think today carries more weight than most summer Fridays. After pausing on Wednesday and moving up yesterday, the market needs to follow through to the upside for me to think the bulls have some fuel left in the tank. A sell-off easily sends the SPX back to the May low (not today, but early next week).

Premarket futures suggest a moderate gap up which isn’t necessarily bullish. Opening gaps are random and most fill the same day.

Today is options expiration day (and the expiration of several other contracts). I don’t think there’s a definite trend on OE day although it does seem to be choppier than most days.

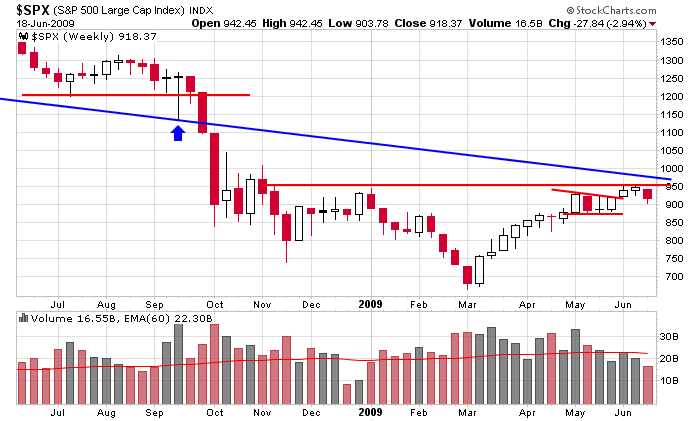

Here’s the SPX weekly. Barring a massive rally, it’ll be the first down week of the last 5 and the third down week since the rally began. That’s not bad. Were you expecting the market to go up week after week?

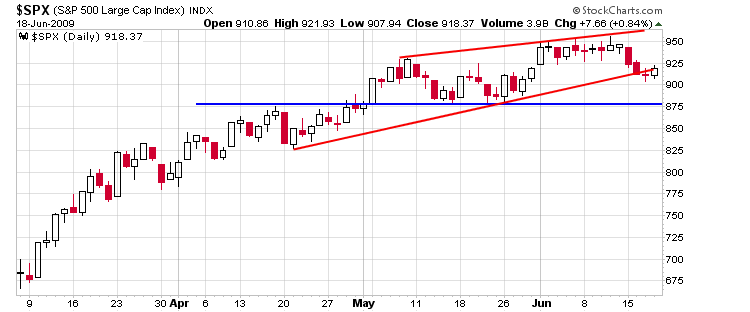

Here’s the SPX daily. As I’ve said, there’s 20 ways to draw support of the wedge, so I’m not going to draw a line in the sand and say: “if X gets taken out, the show’s over.” The market doesn’t act like that. In any case 875 is my key level. Obviously if it doesn’t get tested, the trend will remain up, but if it gets tested and holds, the bounce off the level will be very telling.

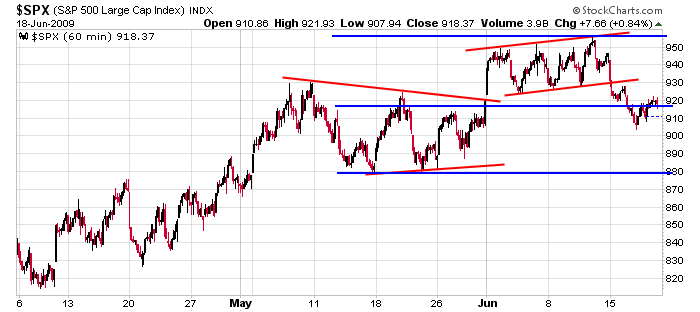

And here’s the SPX 60-min. We are smack in the middle of the range of the last 7 weeks.

That’s it for now. I’m make more comments on the Market Window as the day rolls on. Summer Friday’s are days I cut laggards and get ready to roll the following weak. I typically don’t enter new positions unless they’re too good to pass up, and considering the current environment, I don’t see anything that looks overly great.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases