Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Indonesia, Japan and South Korea each gained about 1%. Europe is currently mostly up. The indexes range from being flat to being up about 0.7%. Futures here in the States point towards a flat or slightly positive open for the cash market.

The dollar is up slightly. Gold, silver and oil are also up.

If the market was supposed to sell off hard after the indexes broke down from their 2-week consolidation periods, the memo was not widely disseminated. For those who believe that once a level is taken out, a downtrend or bear market exists, I ask you where is the cascade of selling?

In my eyes the near term trend is down, and dips are shortable until it becomes obvious that’s a bad idea. But tops take a long time to form. Bottoms can often form in a single horrific washout followed by a huge move up on huge volume. Tops on the other hand tend to be rounded and characterized by several up and down thrusts which act to shake as many traders out of the market in both directions as possible.

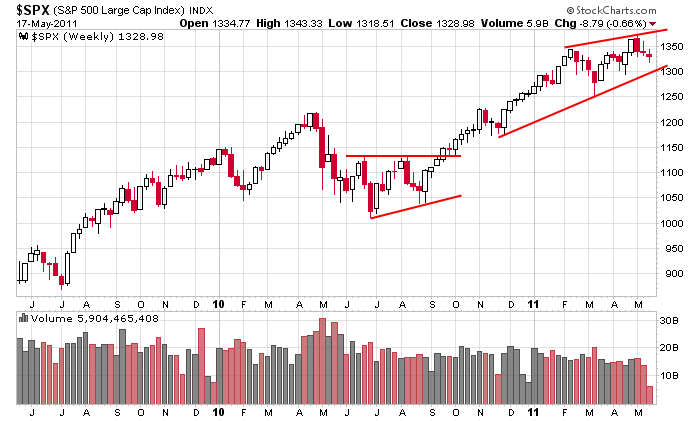

Here’s the SPX weekly. The trend remains up on this longer term time frame…although the rate of ascent is slowing.

Here’s the 60-min chart. Support at 1330 was taken out but a trendline drawn parallel to the top trendline and through the bottom of the pattern has thus far contained the action. Resistance to the upside is 1330 and the top trendline in the high 1340’s. Support is the lowest trendline currently just below 1320.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 18)”

Leave a Reply

You must be logged in to post a comment.

Hard to look in any more, the site is trashed most days.

Try picking things up or is that maids work?

Most likely Whidbey got whipsawed the last 5 or 6

trading sessions, so he’s just poo-hooing about

the whole thing. HW

Hang in here Whidbey, maybe Neal will grow up and learn to play nice yet!! Hate to see Pete M leave .

Last night I was looking at the Daily chart on IBM, and I noticed

that the pattern from late February into early March had a back

and forth pattern which resulted in a huge downside

move for that stock. Today, I see the same format

developing. At least if you look at the Daily chart

on IBM over the last few weeks, it too, will most

likely resolve itself to the downside, I believe. HW

whidbey – you make a good point. Jason’s observations are on target in my opinion.

The major averages seem to be masking the deterioration in the sectors that have led this rally – commodities and the energy sector in particular. The weekly charts are showing negative divergenges and there appears to be distribution as a rounding top forms. The FED is probably OK with a gradual deterioration in stocks with a corresponding move to safety, i.e. a dollar rally and a rally accross the yield curve that keeps interest rates low. In other words, the FED will wait for the deflationary scenario to gain attention before attempting another round of quantitative easing in some form or another. The FED has no other choice – inflate or die!

How do I know this? I had lunch with Chuck Plosser and he told me the FED under BEN has lost control. Ben’s scared witless. A desparate man & a desparate FED. Chuck offered me a job in their technical analysis department (yes Neal – they watch the charts and use them to trigger buying and selling that catches the most traderes on the wrong side). I’m taking the job so you guys are on your own. Best of luck to everyone! Jason, keep up your good work!

Now that Pete M is leaving, we have another room

for the maid to clean up. By the way, what time

is check out time around here? Taxi, taxi!! HW

Attn: Pete M I guess selling vacuum cleaners

door to door didn’t exactly work out, so you

decided to take the job at the Fed. Is that

more or less correct? HW

Howard – it was the day trading that didn’t work out for me a long time ago. Now, please excuse me while I explain Elliott Wave to Chuck in a White Paper I’m preparing for his eyes only.

I’ll continue to monitor this site but without comment (this being an exception as a courtesy to you). Best regards to MAX!

Elliott Wave…is that one word or two words? HW

EW says we are at the begining of ,or in wave 1 of large wave 3 down

and when the dji broke below 12450 and into the april highs ,that ruled out wave 5 of 2 up

they have already done a white paper for the fed–but as u said its inflate until bankrupt

i know my ABC ,thats because i learnt spelling at shool

the fed cant stop a stampede or a daytrader

this useless criminal dead cat bounce since mar 09 has bankrupted the fed and central banks govts around the world and will only led to riots in the streets of the world–the fed is owned by the banks and they are going to get a bond haircut–not even alfa trading can help the fed

Jason is right we are in a choppy distribution phase of toping–a daytraders dream

EUR/USD: EUR looks like it’s behind the eight ball.

TLT: rising off a Higher Low.

SPY: dipping, volume doesn’t look good.

SLV: basing but I don’t think it’s building a base

RichE: check out my post/chart on IBM and

tell me if you see something spooky going

on there? Lately, anytime we’ve seen this

back and forth action on the charts it

always resolves itself to the downside.

IBM: Looking at the charts I’m not sure if it’s leading or lagging the S&P. I’m leaning towards lagging. If I owned it I’d sell a call and buy a put just in case QE3 is disappointing.

Speak rover! Speak!

Elliot Wave ?? … I thought that was a wave Break found off the Coast of Wesetren Australia ?

Good to see u back Neal !., obv my vote helped ; }

Wesetren ?…meant Western..But Not the John Wayne kind !