Good morning. Happy Thursday.

It looks like the market will get off to an uneventful start. Asia/Pacific closed mostly down and Europe currently leans to the downside.

The long term trends remain down (the bounce off the March low has always been a bounce within a downtrend – albeit a big bounce). The intermediate term trend is up (higher highs and higher lows remain in place). The short term trend over the last week is down but considering the last month, sentiment is neutral.

When the trends conflict, it’s best to lay low and not trade aggressively or actively. There are many market participants who are calling a top – they’re saying the market is toast and we’ll be taking out the lows later this summer. Maybe they’re right, but they are the same people who missed the entire rally because they were waiting for the world to come to an end. I prefer trading the charts as they unfold – even if the movement doesn’t make any sense.

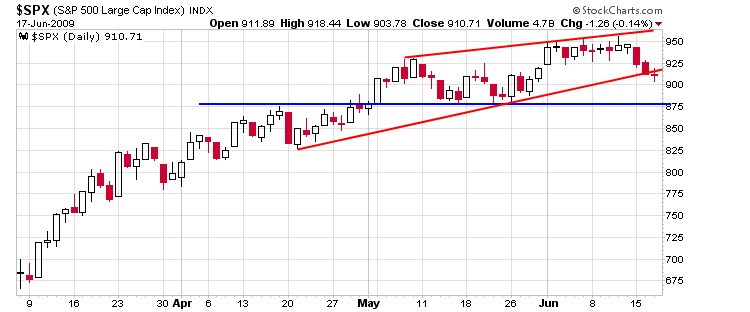

Here’s the daily chart. It’s not in that bad of shape. 875 remains my key level.

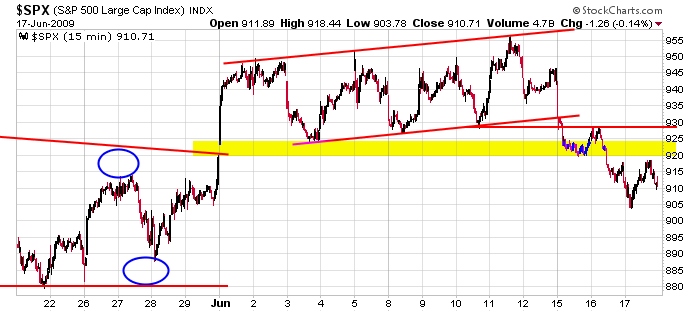

Here’s the 15-min chart over the last 4 weeks…an obvious breakdown from an up-sloping channel. The short term implications are bearish, so the bulls have some work to do if they’re going to regain control.

I’m not trading aggressively here. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases