Good morning. Happy Wednesday.

For the second consecutive day the market put in a decent sized red candle (market opens near the high and closes near the low). Each time this has happened since the March low, the bulls have stepped up and defended their turf, but this time is a little different because the internal breadth indicators continue to move down. Let’s cover some of them.

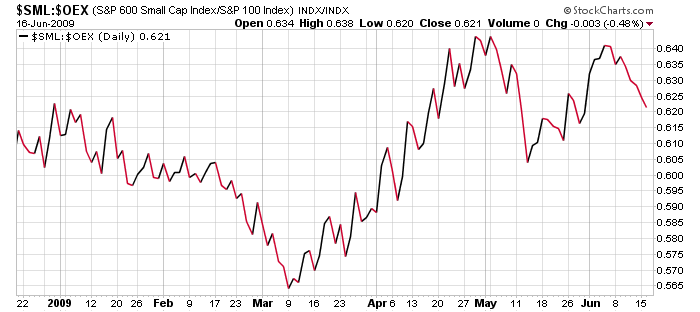

The small caps are no longer out-performing the large caps.

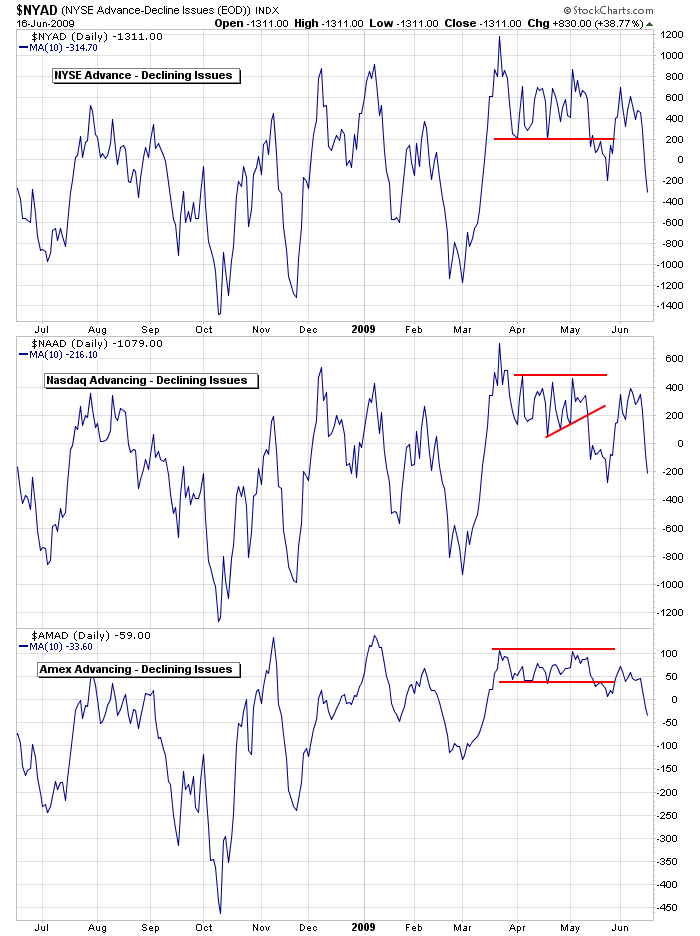

Advancers – Decliners have put in two lower highs and are either registering a new low or are very close to it.

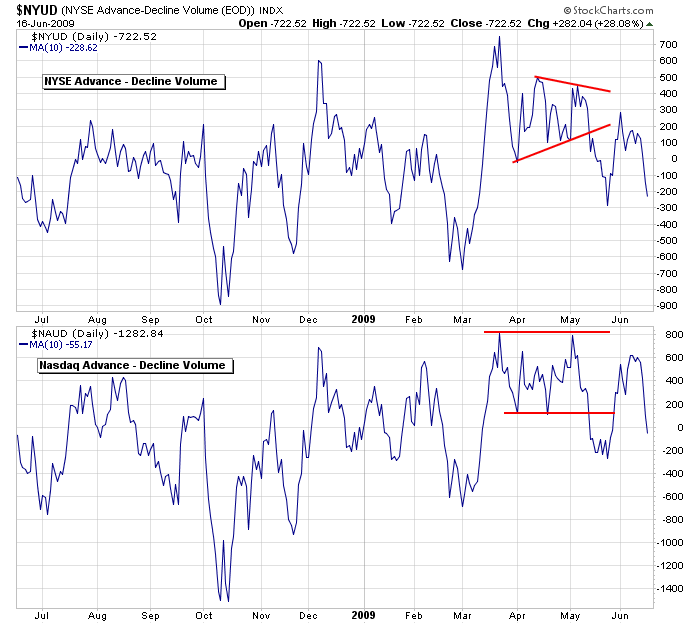

Advancing – Declining Volume couldn’t make a new high when the market did so last Thursday.

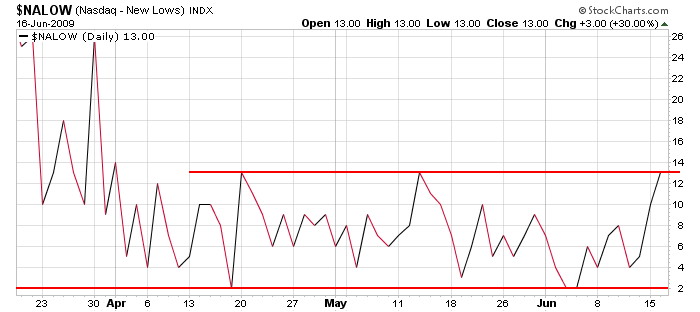

The number of stocks making new lows at the Nasdaq is on the verge of breaking out.

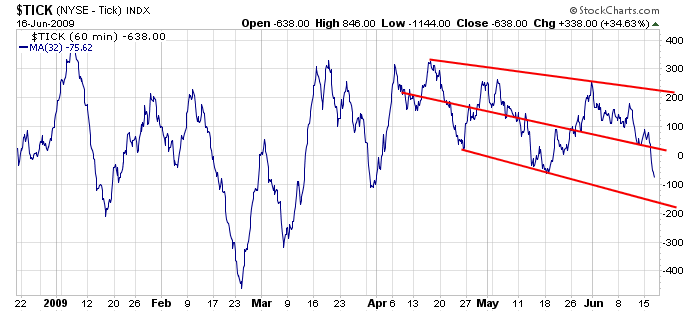

The 32-MA of the 60-min TICK continues to move down.

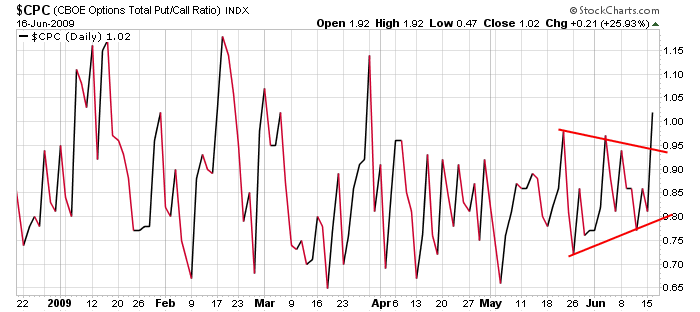

The Put/Call Ratio has broken out and moved above 1.0 for the first time since late March.

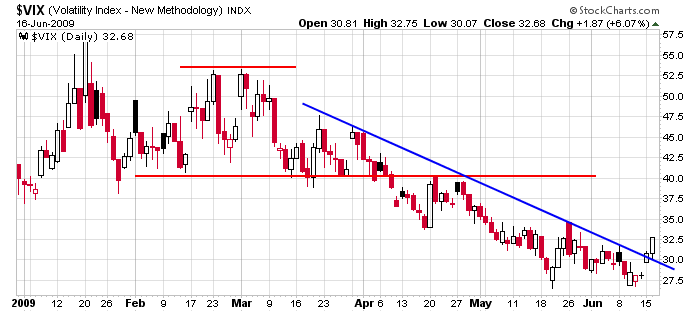

The VIX is still at a low level but the trend looks to be turning.

Technically the trend is still up because the indexes continue to make higher highs and higher lows, there are warning signs. Don’t ignore them. Play good defense. After a couple months of going long, the tide may be turning.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases