Good morning. Happy Monday. Hope you had a nice weekend.

It’s not a happy day for the world markets. The Asian/Pacific markets got hit hard. Almost every index closed down more than 1% and several dropped more than 2%. Europe is currently experiencing across-the-board losses greater than 1%. Futures here in the States point towards a large gap down for the cash market.

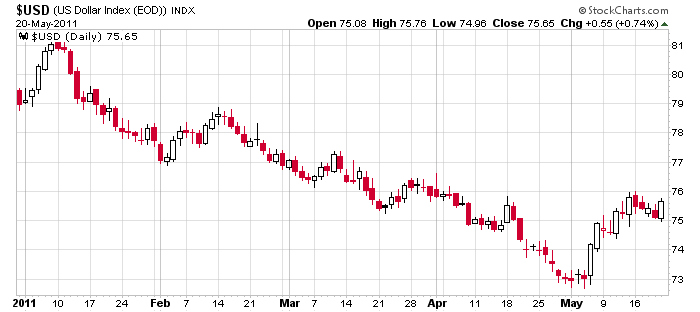

The US dollar is up about 1%. Gold, silver and oil are down.

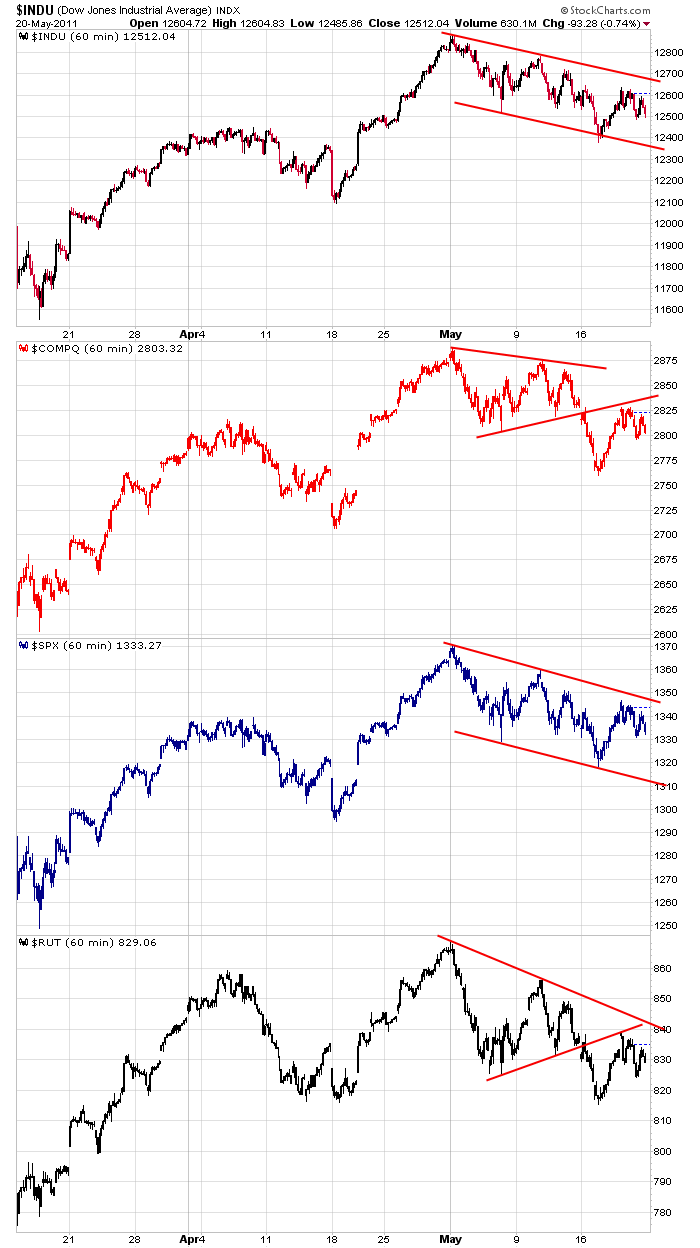

I don’t have much to add to the report I posted over the weekend. The Dow and S&P are trading in down-sloping channels. The Nas and Russell broke support and then got rejected by resistance on the following bounce. All the charts (see below) are trending down and have negative biases.

And here’s the dollar chart. As of now, today’s open will be above 76. Say what you want about the Fed printing money etc, if the euro is going to be weak, the dollar is the safe-haven place of choice, and a strong dollar is not good for the US economy or the stock market.

Some will say Greece doesn’t matter because it’s such a small country. Wrong. It does matter because problems in Greece mean problems for the euro which means stregth for the dollar which means weakness for commodities and the US markets. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 23)”

Leave a Reply

You must be logged in to post a comment.

Zen Master Neal: Have you forgotten something? The student always

learns better than the Master ever can. You start to listen

to Maxie boy and HW for good Zen trading techniques. HW

trade the charts on 1 and 5 min –the 1st hour was sideways chop at S3 low piviot and zero line sideways nutral tick chart –so no trade but a ind to exit preopen shorts

instos go by the rule that they will go for gap fill in first hour and if cant make it then the direction is the way it was headed

the intraday trend is down and could go to S5 piviot but the intraday is stretched to downside–so looking for a break of ist hours sideways choppy

may just be coming now–bye

im looking for 1308-10 spx but thats a probability and a good gambler only trades reality

Neal,

i am outside the physical universe trading,i simply use the physical body to place my orders for me—-is that what a zen master does

From IVolatility.com (sectors rotating from Industrials & Raw Materials to consumer staple)

Strategy

As most of the leading industrial and raw material stocks have declined below their upward sloping trendlines from last August notable lows, the equity leadership picture has changed with relative strength now shifting to consumer staple stocks.

One way to measure the rotation, is to divide the Consumer Discretionary Select Sector SPDR (XLY) 40.27 by the Consumer Staples Select Sector SPDR (XLP) 32.32 creating an index. Index values above one indicate the discretionary sector is performing relative better than the stapes. The daily chart below shows the status of the diminishing index value.

the ftse and dax were held stagnant in a narrow range after a initial drop –so is the euro

so thats the usa sideways chop

any break out will also be with the euro for after europes close now

Friday was a good trading day. Today is just a gamble

until something breaks out one way or the other. HW

just woke up and doesnt look good –a meager rally that was sold into

asia will be watched carefully