Good morning. Happy Tuesday.

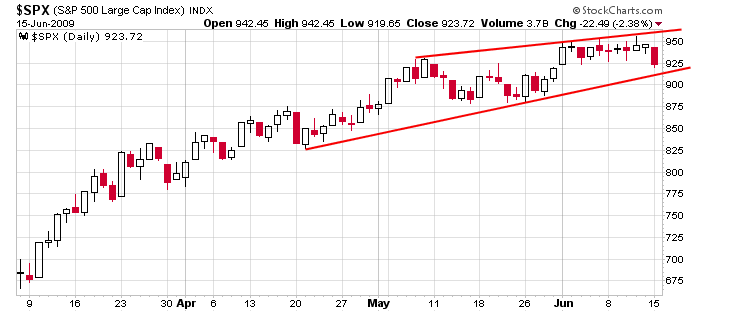

So the market attempted to break out last Thursday but failed, and then yesterday it dropped to fill its June 1 gap up. The bulls are ecstatic one day and thoroughly frustrated shortly after. Here’s the SPX daily. One day doesn’t change the trend. We’ve had several of these scary one-day sell-offs the last couple months and each time the bulls dug their heels in and defended their turf. Their backs are up against the wall yet, but continued weakness will once again put the pressure on. One of these days the bulls won’t be able to hold the line and a top will form, but I’m not too interested in guessing when that will be. As I like to say, a stopped clock is correct twice a day. One of these days the bears will be correct, but they’ve missed big portions of the rally because they’ve been guessing a top all the way up. Trade what happens, not what you want to happen or think should happen. The out-sized role the government has been playing along with free money for the banks in the form of rock-bottom interest rates paved the way for the market to go a little further than anyone could have expected at the March low. Why fight it?

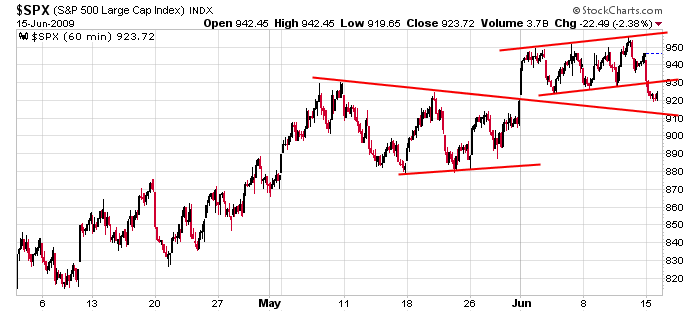

Maybe a top is in place, maybe it isn’t. One day doesn’t change a trend. This doesn’t mean I’d blindly hold positions which aren’t working out, but it does mean I’m not aggressively going short just because the market dropped one day. Here’s the 60-min chart. It identifies a potential support level should we see more weakness today.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases