Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Australia, China and S. Korea lost more than 0.9%. Europe is currently mostly down. Only Austria is posting a significant loss. Futures here in the States point towards a down open for the cash market, which is much better than where the futures were last night.

The US dollar is basically flat. Gold and silver are up. Oil is down slightly.

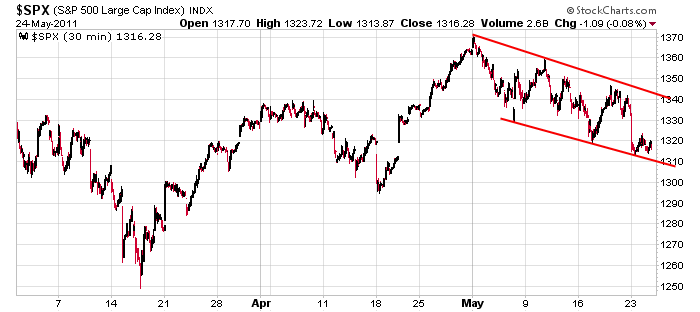

In my opinion, the bulls don’t have much room for error here. All downtrends start as innocent pullbacks within uptrends, but at some point, the pullback goes too far and the uptrend is not salvageable until a complete washout occurs. This is the current situation. Here’s the 30-min SPX chart. The bulls do not want to see the index fall below the pattern.

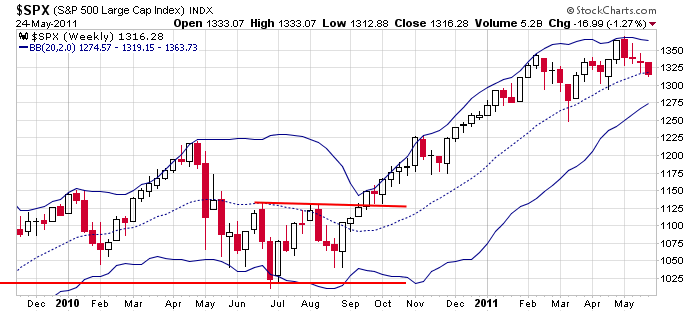

And here’s the weekly. For the first time since last August, the index is in jeopardy of closing below its 20-day EMA which is in the middle of the Bollinger Bands. If this happens, odds favor a move to the lower band which is currently at 1275.

Until proven unwise, I’m going to continue playing this like a downtrend. That means bounces are shortable. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 25)”

Leave a Reply

You must be logged in to post a comment.

from 5/24: Jordan Kotick, Barclays Capital states: “there are a few

catalysts to send the market lower. If you think of the marriage

of European events and the end of the Fed easing and summer

illiquidity, you have the perfect setup for a correction.”

Dow +80 points sometime during the trading day today. HW

I think I’ll short commodities. CAT: Gapped down 5/23. Are you still missing with it Howard? And, from Wealth Wire: “Commodities Rise as Goldman Recommends Buying” Goldman, IMO reads yesterday’s newspapers.

EUR/USD; UUP, UDN: Looks like heavy betting on the USD upside.

SLV: I’m shorting it at $36.50

SPY: Jason does S&P, but was the gap down 5/23 to fill the 4/20 gap up? I don’t think so.

TLT: Talk about an uptrend. Is it because of Gov’ment spending? I don’t think so.

IBM: I’m buying an OTM PUT.

IMO equities and commodities are going down and the USD will go up. I think we’re on the contraction arc of the sector rotation cycle.

RichE: what’s all the buzz about IBM? HW

OMG: I feel like the, “Doom & Gloom” preacher on the street corner.

From Zacks: So be prepared for trader reactions to the Durable Goods on Wednesday followed by GDP revision and Jobless Claims on Thursday. Finishing off the week are Personal Incomes and Consumer Sentiment on Friday. As noted yesterday, we need 3 or 4 of these reports in the plus column to turn the tide. If not, then expect recent weakness to persist.

The perfect master gets his cryptic messages from this song:

‘The Rain, the Park and Other things’ by the Cowsills. HW

I feel like I’m on a Monty Python quest. Tomatoes = TOM = TOMTOM? EURs I have not to pray Arnold finds his way from his Tomato Garden.

Perfect Master: Since you are perfect then you know nothing is new to you, but me being an imperfect pagan, everything is new. So I did tell you something new, new to me.

The Rain, the Park and Other things’ by the Cowsills. I thought that song was about LSD. So, buy drug stocks?

i challege Neal,—im perfect

but Neal may return

he may make more sence then

(#2) Sometime during the day today, the Dow will

trade + 80 points to the upside. HW

the fed was very kind in giving me a chance to load up short for the asian session

dont worry Neal ,i am a scalper,–i could be in/out 3 to 4 times be usa open

by–spelling error

out at asian open,for a profit from dayly high piviot to main piviot on all indexes

but thank u Neal for ur heads up and i agree we could get a few days releif rally

whilst we dont have too cosidering the way the euro is shoting up its very pos

u do have some good points Neal ,if only u could control ur fantasies