Good morning. Happy Monday. Hope you had a nice weekend.

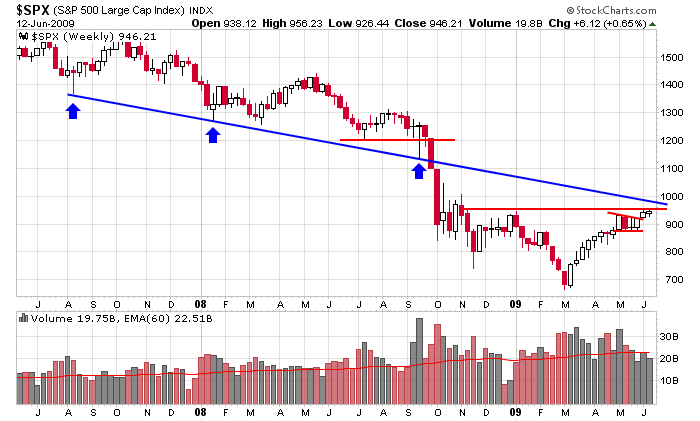

Other than a brief breakout attempt last Thursday which the small caps didn’t participate in, the indexes remained in their consolidation mode. Here’s the weekly. It’d be nice to get some follow through to better solidify the breakout from the 4-week consolidation pattern, but resistance at 950 is still.

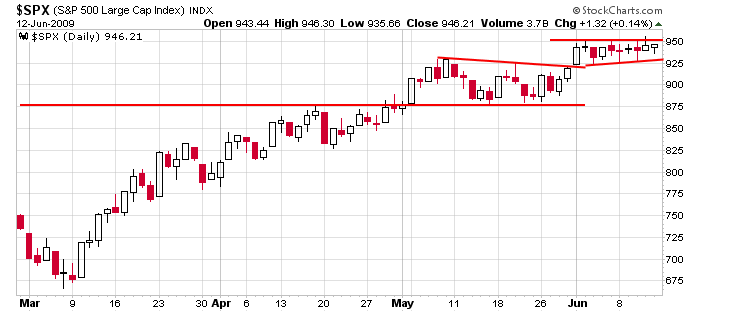

Here’s the daily. One pattern to the next…and they’re getting smaller and tighter. Can the market bust out explosively during the summer? I say yes –especially given the role the government is playing, but I’m not placing big bets until it happens.

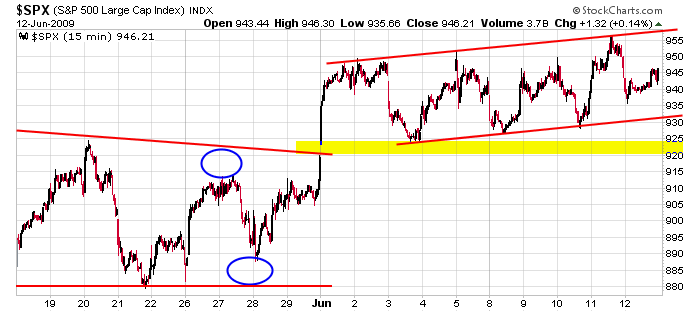

Here’s the 15-min. The market has been range bound for 2 weeks, and we still have an unfilled gap below.

The Asian/Pacific markets closed mostly down…Europe is currently down across the board…premarket futures trading here in the States suggests a large opening gap down. News from over the weekend surrounds the Group of Eight finance minister meeting where top officials said they would look to end their monetary and fiscal stimulus. Nobody will deny the government has propped up the banks (wouldn’t let the weak die) and this in turn has propped up the market. The economy isn’t recovering (see the unemployment numbers and housing situation), so what happens if the banks are taken off life support?

The trend is up, but as stated over the weekend, there are starting to be warning signs from the breadth indicators.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases