Good morning. Happy Friday.

If you look at closing prices only, yesterday extended the market’s consolidation period. But if you consider the intraday movement, most of the indexes made a definite breakout attempt only to get sold into and close below resistance. The large caps, mid caps and tech stocks made new highs. The small caps did not. The divergence – the lack of confirmation from the small caps – warned the breakout may not hold.

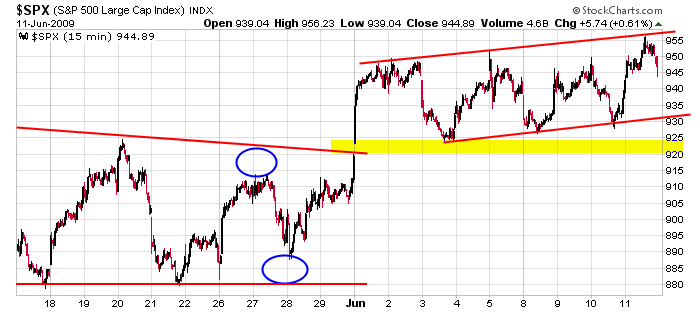

Here’s the 15-min SPX chart. Instead of sideways consolidation with easily definable resistance, we have a pattern of higher highs and higher lows. This is much less bullish because it hints at traders slowly getting into the market (less bullish because we need traders in cash on the sidelines so when a breakout attempt is made, that money can come into the market), and it increases the odds of a breakdown rather than a surge up.

The overall trend is up, and I’ll maintain my stance that it’s ok to be less bullish, but guessing a top is something I’m not interested in. How many times the last couple months have the bears incorrectly called a top?

It’s Friday. Manage your positions. Dump the underperformers and get ready for another big week next week.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases