Good morning. Happy Thursday.

Yesterday was a wild ride, but in the end the closing losses were relatively small and the consolidation period was maintained.

For 7 straight days the market has moved in a tight range. Each dip gets bought; each rally gets sold. There have been lots of day trading opportunities, and we’ve had our share of swing trades too – although our holding time on some has needed to be shortened.

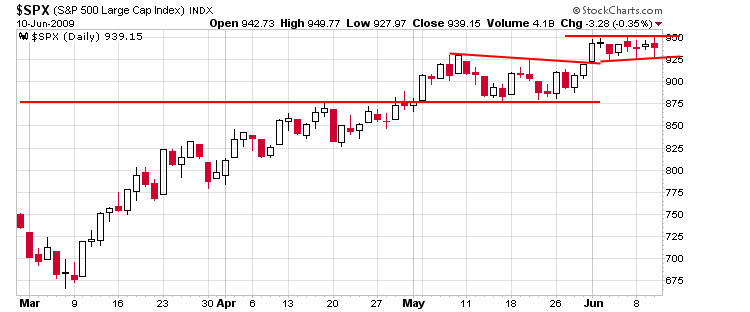

Here’s the SPX daily. I continue to see nothing wrong with this chart…a solid rally off the March low turned into 4 weeks on consolidation during May and now we’re getting another 2 weeks here in June. If you stare at your screen all day long, you’ll be tempted to over-analyze the situation. If you back up and see the bigger picture, you’ll see the trend is solid and there’s no reason to guess a top.

News isn’t very good. The unemployment rate is above 9%…gas prices are up 30% off their lows…mortgage rates are up a full percent off their lows…and the Fed Fund futures are started to predict small odds the Fed raises rates this fall. None of this is good yet the market keeps on keepin on. Imagine what would happen if we got good news?

Trade the charts…not what you think should happen. The market is forward looking. It trades off what it anticipates down the line. Right now expectations are high. If the economy doesn’t improve, then we’ll deal with that later, but for now the trend remains up.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases