Good morning. Happy Wednesday.

For now the consolidation continues. Two Monday’s ago the market broke out, but little follow through has been seen. For 6 straight days the indexes have been range bound, but things will get interesting at today’s open. Premarket futures trading suggests a large gap up, so we’ll get a chance to see who flinches first. Will the gap up cause momentum players to jump aboard for fear they’ll miss the rally and shorts to cover or will this be another gap and crap day like?

The trend is up, so my bias is to the long side. As I’ve been saying, it’s ok to be less bullish right now because market is well off its lows and drifting sideways but there’s no reason to be bearish.

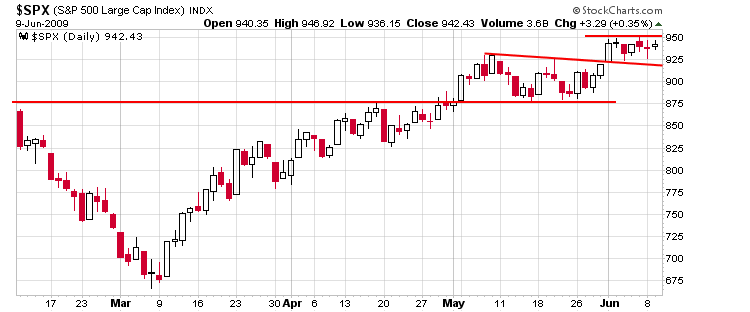

Here’s the SPX daily. 950 is a key level – it will be challenged at today’s open. I don’t like the idea of another unfilled gap (should the market gap up and run), but it’s not like this will be the only unfilled gap on the chart. The target I established a couple weeks ago is 975.

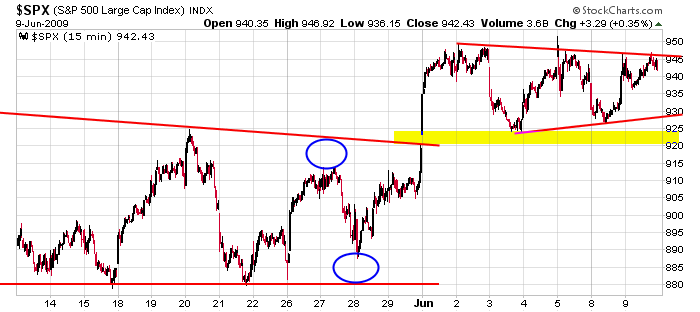

Here’s the SPX 15-min chart. As long as the futures don’t pull back the next hour, today’s open will be around last Friday’s high.

That’s it for now. Hopefully the market can break free from its range and we can get a little trending move that lasts into next week.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases