Good morning. Happy Friday. Happy employment numbers day.

The Asian/Pacific markets closed mixed and with a bearish slant. Europe is currently also mixed but the down markets are down much more than the up markets are up. Futures here in the States point toward a gap down open for the cash market, but this could change when the employment numbers are released.

Here are the numbers:

unemployment rate: 9.1% (from 9.0%)

nonfarm payrolls: up 54K (vs. 174K estimated)

private payrolls: will post when I get number

average workweek: will post when I get number

hourly earnings: 0.3% (vs. 0.2% estimated)

The number of new jobs created and the unemployment rate are big dissapointments, and the futures market is reacting accordingly. The S&P futures, which were down about 4, are now down about 15. Today’s open will be at a new low and will be very close to invalidating the falling wedge and rectangle patterns the bulls were hoping would resolve up. And on a longer term basis, things continue to deteriorate.

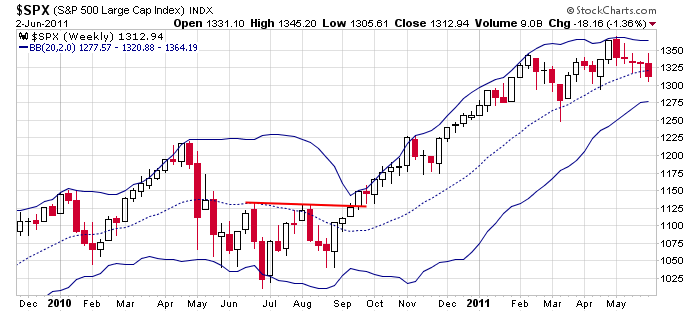

Here’s the weekly S&P chart. Unless the index rallies 8 points today, it’ll close below the center of its Bollinger Bands (20-day MA) for the first time since last August.

There was a glimmer of hope when this week started. Now the bulls are in a very tough situation. The economy is slipping and the weakest time of year is upon us. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 3)”

Leave a Reply

You must be logged in to post a comment.

Relevant to the subject at hand. We are in the end of month

beginning of month bullish cycle, so typically we should

see some bouyancy in the market. NO DOUBT THE FED WILL

WAIT UNTIL THE FINAL HOUR OF TRADING TODAY TO SEE IF THEY

CAN OR WILL MAKE SOME SORT OF AN ATTEMPT TO PULL A RABBIT OUT

OF THEIR HAT AND WIND UP WITH THE WEEKLY CHARTS IN GOOD SHAPE.

The Fed is going to let the market go down so that eventually people cry “uncle” and beg for QE3. They can’t do it without fear and loathing, but when it gets bad enough, they will be there to “save us.”

If people are going to cry ‘QE3’ we should

hear some hint of that no later than today

by some Fed official or govt representative.

my 2 pet bears–teddy and grizelly ,that live in my basement,are going to teach the fed to short sell

Big guys don’t have to get QE3 to make some good money. They could raise the interest rate and collect the money from financing the govt debt.

IBM: Is being bought-up, but I don’t think its enough to breach the 166. Not sure if I’ll hold or sell my PUT and go LONG SAIL and AWAY.

IBM 5min chart going up, but the 15 min chart

is still headed south. I’ll keep an eye on it.

According to Sector Rotation, in a contracting economy, Energy peeks; Health Care, Utilities, Staples, and then Financials go up; and then the economy turns and Tech goes up. I think I’ll play IBM short until the Financials turn.

12noon IBM just got a quick pop into the 165-166

area and pulled back abruptly. Apparently on

light volume, I suppose. HW

Looks like stocks r being bought and the VIX is calming down. Not sure how to read TLT. It must be the GOV’ment isn’t going to buy bonds anymore.

Neal, I don’t disagree with you on QE3. I think it’s a good idea the banks and corporate step up, but I fear it’s going to granny.

I think the Perfect Master needs to meditate in the shade of plum tree.

What I want is less corruption. That will lower the need for Big Gov’ment.

I’m already there, dude. I’m already chillin for today. HW

what has terrible tim been up too ,Neal

Sorry, Neal you’ll have to speak to my agent if

you want me to fill the starring role in any

of your hypothetical, dreamt up movies. HW

BIDU is a good trading stock, for today, anyway.

i will play any role–even terrible tim

is terrible buying the euro today

Looks like the VIX is under the Plum Tree also.

IBM: Has to hold 165. If it drops below 164.50 it’ll be, “Gone With the Wind”

LUX: You movie stars will need sun-glasses

The market has to go down a little bit more,

hit that bottom channel and bouce, I suppose?

And then back to magnet area of SPX 1314-1316.

Conclusion: As long as we close above 1310 nobody,

I mean nobody is going to get too alarmed about that.

reiterate my previous comment about BIDU

it appears to be a good trading stock both

on the 1 min and 5 min charts. I’ll see

how it goes next week on a follow through.