Good morning. Happy Tuesday.

It looks like we’ll begin the day with a small gap up. Futures are trading up a couple points.

Yesterday was pretty dull until the last hour when the market surged higher and then gave half the gains back into the close. Other than the Friday before Memorial Day weekend, volume was the lightest it’s been in a month.

From an analysis standpoint, the market isn’t changing much day to day – the trend is up. Yes there are charts that would suggest the indexes are due to rollover or at least pause, but they’ve been like that for several weeks and here we are not very far from new highs.

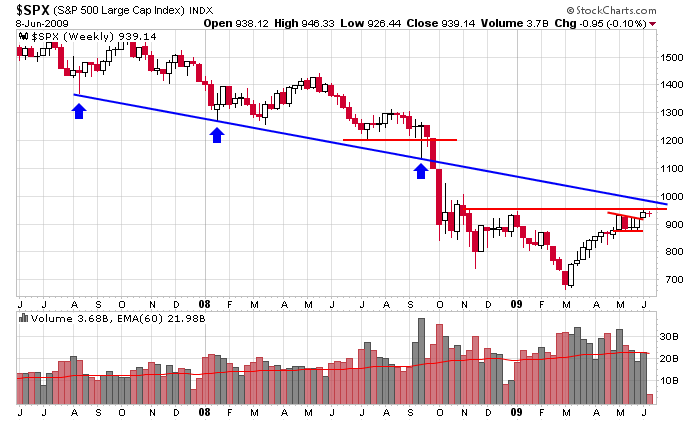

Here’s the SPX weekly. It broke out from a 4-week wedge pattern but hasn’t gotten much follow through. 950 is a key level it now has to deal with, and after that, as long as 975 isn’t too tough to overcome, the target is 1025.

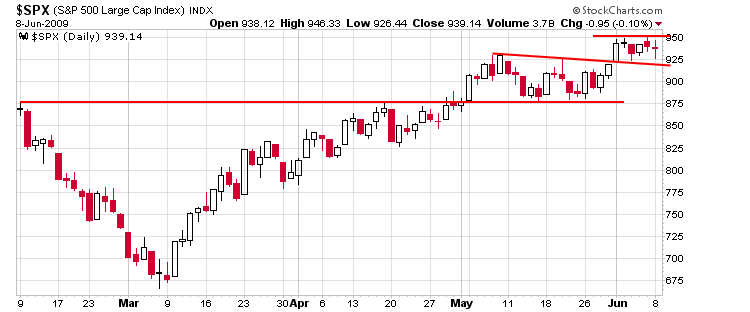

Here’s the daily SPX. There’s nothing wrong with this chart. I’ve been saying this for 6 weeks. Higher highs and higher lows are being registered. Given the move off the lows, it’s ok to be less bullish, but there’s no reason to be bearish.

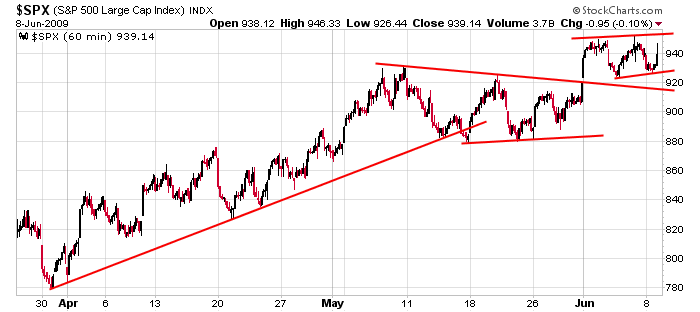

Here’s the 60-min. Perhaps it’s a slight concern the recent pattern is slanting up, but otherwise, there are no warning signs (although there’s still an unfilled gap near 920).

I feel like a broken record because the market has been grinding for so long, and I don’t like over analyzing things. It’s “2 steps forward and 2 steps back” and since the up days are bigger than the down days, we have a net gain. But the market as a whole isn’t following through much. Trade the best patterns only – it only takes one or two good trades each week to make solid profits.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases