Good morning. Happy Monday. Hope you had a nice weekend.

The indexes made new highs last Friday but then sold off immediately and closed with small losses. Supposedly the number of people filing to collect unemployment dropped yet the unemployment rate increased more than expected.

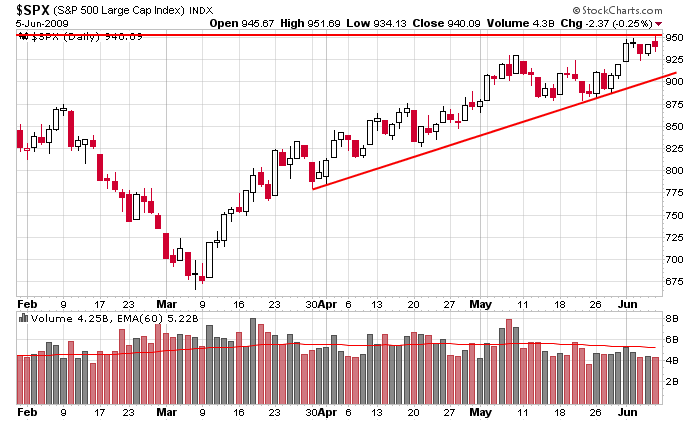

The trend continues to be up, so my bias remains on the long side. But this isn’t exactly a rip-roaring rally. Over the last 6 weeks the number of down days has matched the number of up days. The market of course is up over this time period because the gains on the up days have been bigger then the losses on down days, but while we’ve complimented the bulls because every dip has gotten bought, the bears haven’t let the market run wild. Given the gains you’d think it was “2 steps forward, 1 step back” or “4/5 steps forward, 2 steps back” and then onwards and upwards again. But that hasn’t been the case. It’s more like “1 big step forward, 1 moderate step back.” Over 6 weeks, there’s a pretty good net gain and of course many individual stocks have done well, but the day to day action is frustrating because there’s a lack of follow through. Oh well. It is what it is. The trend is up, and if you want to be less bullish, fine. But I see no reason to be bearish.

Here’s the SPX daily…slow and steady. Even though my target is 975, 950 is resistance from early January.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases