Good morning. Happy Friday.

The Asian/Pacific markets closed mixed – South Korea and Taiwan lost more than 1%. Europe is currently mostly down, but there are no big losers. Futures here in the States point towards a slight down open for the cash market.

So the market finally bounced yesterday, but it wasn’t an impressive bounce. It lacked energy and enthusiasm and volume, and it was not characterized by buying surges. Buyers were not eager to buy; shorts were not eager to cover. The indexes can continue up today (or for a few more days), but for me to believe the bounce can last more than a couple days, I need to see more energy.

For now my stance stays the same. The trend is down…it’s ok to take some profits here with shorts, but don’t take complete profits…maintain some exposure just in case the market melts down. If you want to go long, fine. Just know it’s likely to be a very short term trade.

I have no idea what the Fed has up its sleeve, but if left alone, the market will continue down for the foreseeable future.

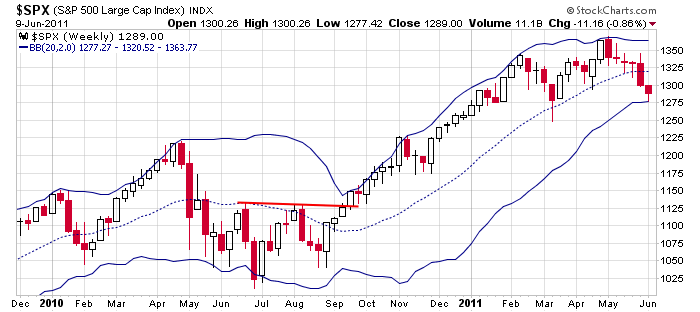

Here’s the SPX week. My first downside target (bottom Bollinger Band of weekly chart) has been hit. Next is 1250ish. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 10)”

Leave a Reply

You must be logged in to post a comment.

the preopen has been fun

just been playing in/out the dax for 30 points a pop

same with dji spx and ndx

the ftse has been a bit slower

no thats what i call sideways channels

—oops we are geting a channel breakout –have to extend

It’s a little disconcerting right now to see the Dow futures

are down (-) 45 and Gold is down (-) 14.60. This, according

to Elliott Wave theory, is supposed to be very bearish. HW

Tio: Would you provide an example for the past ten trading days.

the market is very simple

it just moves between support and res

Why is my Zen master teaching commodities 101 to

a non-believer? Someone who questions the Zen’s reasonings?

is the selling over

neal u dont know how to day trasde

i closed my shorts at 11.19 just before i gave the heads up and europe close

just woke up now so maybe its time to go short soon

go ask the desperate fed what its going to do next

there are no buyers

tell the fed to come clean about its criminal ponsi

oops maybe thats my selling causing the markets to go down

only joking–im going back to sleep

ive made a packet pre market to europe close

ever stoped to think this is banks having to raise capital reqiements and opts related selling

a capitulation bottom—perhaps

bof a is closing its bond prop trading desk

fed was buying bank etf today

im only extramely good because i use the Pattern Trapper technique

not finished yet,Neal

but thinking of getting his inds on esignal