Good morning. Happy Friday.

As stated yesterday, today will be a half day for me. I have a wedding in Breckenridge this afternoon (a wedding on a Friday afternoon???), so I’ll be ducking out early.

On to the market…

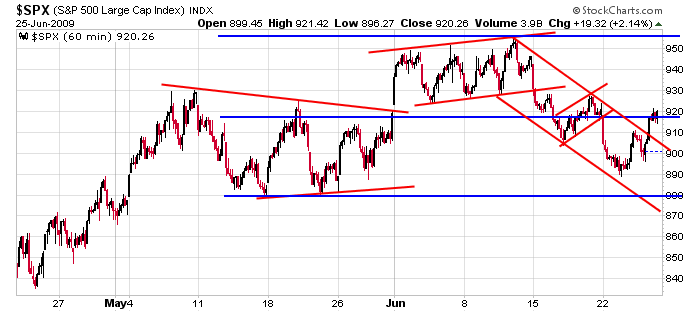

The S&P is up 1 for the month of June – not bad considering it’s the beginning of the “worst 5 months of the year.” It’s also down 1 point for the week. Whether it officially closes up or down for the week probably doesn’t matter. Barring a stiff sell-off, the week will end with a long bottoming tail and a close in the upper part if the intraweek range – again, not bad.

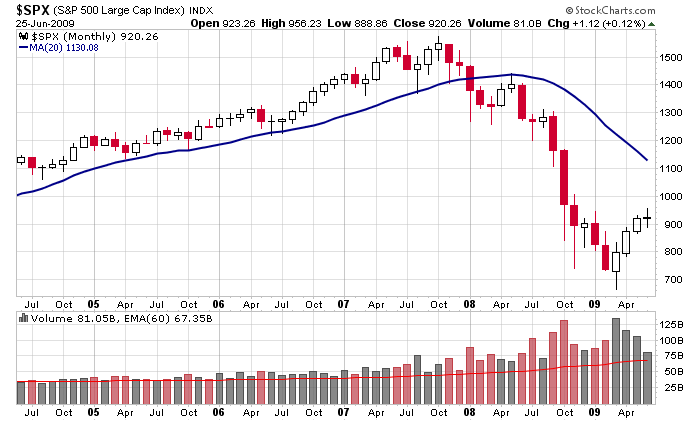

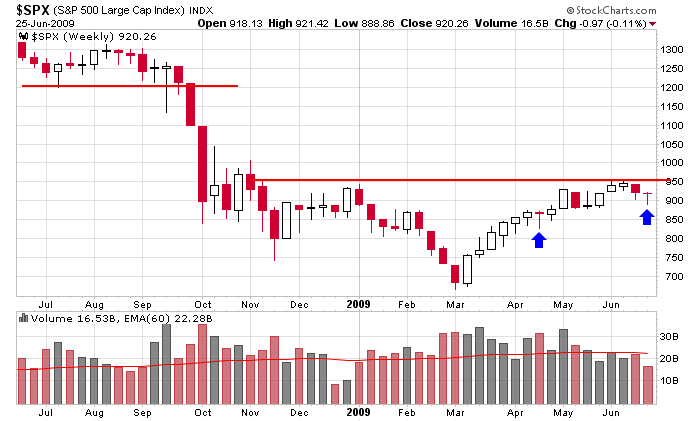

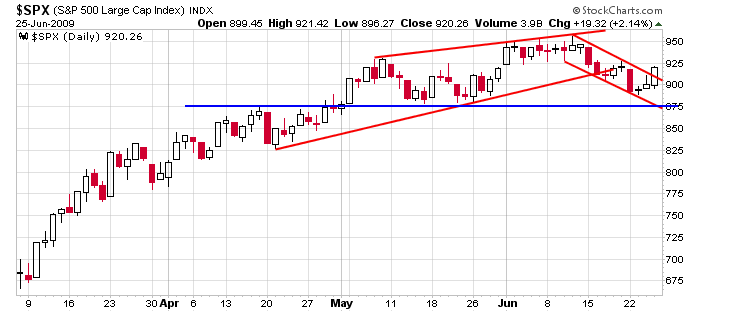

Below are the SPX monthly, weekly, daily and 60-min charts: The monthly shows 4 consecutive up months but volume is declining. The weekly shows a really nice rally off the March low but the rate of ascent has declined. This is perfectly normal for an issue to rest before legging up again. The daily shows a break down from a rising wedge, but the pattern of higher highs and higher lows remains in place. And we may have gotten a breakout from falling flag yesterday. The 60-min indicates the market is unchanged since the beginning of May and smack in the middle of its trading range.

Have a good day; have a great weekend. I’m heading up to the mountains in a few hours.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases